EPIC TAX PARTY 🎊. Unfinished Epic Tax Guy

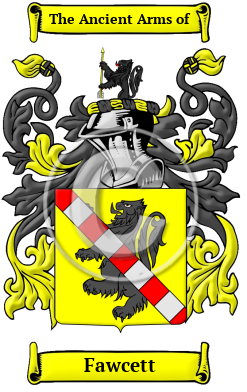

The name Fawcett is derived from an ancient word meaning "fox on a hillside." Fa’side … This is Finnish side

Castle, sometimes known as Fawside, Falside, Ffauside, Fauxside, or Fawsyde, is a 14th century Keep located in East Lothian, approximately 2 miles southwest of Tranent, and two miles southeast of Musselburgh. The castle dates to 1189, when the monks of Newbattle Abbey granted land to Saer de Quincy, 1st Earl of Winchester to build the castle on the site. Today the privately held castle still stands and includes a Bed and Breakfast for the weary traveler.

🎼 🎵 Led Zeppelin and we are so excited 😆

Ranking The Best Rock Bands of the 1970’s

🎶

The Tyla Stories Behind 7 July Julie Drinks Named After Real Musical People

To quote from a scene of

the Australian movie The

Castle, there is an item of Australian tax law that really does

depend on “the vibe”. In this particular ruling, the words used however are “ambience” and

“atmosphere”.

Taxation ruling TR 2007/9 describes the circumstances when an item used to create a particular

atmosphere or ambience in a consumer-facing environment, for example in a cafe,

restaurant, licensed club or hotel, constitutes an item of plant for the

purposes of determining whether a deduction is available under either Division

40 (for depreciating assets) or Division 43 (for capital works).

Think, for example, of a restaurant that has decorated its dining area as a

medieval banquet hall. As part of the medieval theme, replicas of stone walls

are constructed out of painted polystyrene and are fastened to the walls, as

are themed lights that look like flaming torches.

The polystyrene walls and the themed lights do not form part of the structure

of the building, but retain a separate visual identity with the sole purpose of

creating an atmosphere or ambience to entice customers and add to their dining

experience. Being so related to the restaurant's business, the Commissioner

holds that the items come within the ordinary meaning of “plant” and are

therefore deductible as such.