Nowhere to hide’: New gig economy reporting regime set to debut

Taking on the Tax Reform challenge

The Tax Institute has launched our ground-breaking paper, The Case for Change. The completion of this report is a major milestone in our work towards a fairer, simpler and more efficient tax system. This message from our Director, Tax Policy and Technical, Andrew Mills, CTA (Life) appeared in today's member newsletter, TaxVine.

Twelve months ago, The Tax Institute embarked on an ambitious program that engages one of its core purposes, that of advocating for a better tax system. As I wrote in an earlier edition of TaxVine this year, that process has involved gathering input from hundreds of members and volunteers as well as from other stakeholders in the system. From July to November 2020, members had the opportunity to observe or be involved in discussions, webinars, presentations, idea generation, paper preparation and The Tax Summit: Project Reform edition.

Australia's tax laws are costing the nation about $50 billion in compliance costs, while inefficient taxes are costing even more in lost economic growth, the Tax Institute has warned.

Key points:

- The Tax Institute report argues Australia is over-reliant on personal and company income taxes

- It argues for a higher rate and/or broader base for the GST, which may include taxing education, health and fresh food

- The report says Australia's super system is too complex and the tax breaks remain far too generous

Tax Institute releases 287-page reform wish list to fix 'broken' taxation system

What is an ATO e-Audit, and how can you be prepared?

If you are flagged by the Australian Taxation Office (ATO) for an audit, and you maintain electronic financial records, you may be subject to an e-Audit. This may be a preferred option as it can streamline the audit process and minimise cost and disruption to your business, but it pays to be prepared.

The ATO provides insight into the e-Audit processand the types of information it will likely require from you.

The e-Audit process

The e-Audit process comprises the following stages:

Access to and supply of electronic information

The ATO will usually seek access to your records through a cooperative approach, but in some instances it may utilise its formal access powers, such as in cases involving potential tax avoidance.

Even where information is to be supplied electronically, the ATO will still schedule a meeting with you to develop an understanding of your system and identify what information they need to collect.

Data review and analysis

The ATO uses specialised software to verify that the data that you provide is accurate and complete. It then conducts a series of tests on this data to ensure you comply with tax laws.

The data is not altered as part of this process, but nevertheless, it is recommended to keep a backup of the data supplied to the ATO.

Completion

When the audit and compliance activity is completed, the data you provided to the ATO will be stored as part of a case file kept as a record of the compliance activity. This information is protected by law.

Information systems risk assessment

As part of the e-Audit process, the ATO may use its information systems risk assessment (ISRA) tool to assess your system’s risks regarding the correct reporting of your tax and super obligations. A report will be prepared which highlights any compliance risks and provides recommendations to mitigate them.

Being prepared

If you are subject to an e-Audit and ISRA, you will save time and minimise disruption by having all the relevant information and documentation readily available.

For an e-Audit, this may include the names and versions of all software and systems used to meet your tax obligations, contact details of the accountant who prepares your BAS or financial records, and system support documentation which can include a system architecture diagram, data dictionary, BAS preparation papers and other working papers.

Similar information may be required for an ISRA, as well as additional information such as data entry processes, IT contracts for system maintenance, roles and responsibilities across accounting and IT teams, and disaster recovery plans.

Conclusion

If you are on the ATO’s radar for an audit, and your financial records are kept electronically, you may be subject to an e-Audit and information systems risk assessment. These processes help the ATO to ensure that you are compliant with tax laws, and that the information systems used to support your business have a high level of integrity.

It helps to be prepared and have all relevant documentation available. This will minimise disruption to your business if you do become the subject of an e-Audit.

Vaccine passports can now be demanded by any business, anywhere (including strip clubs!)

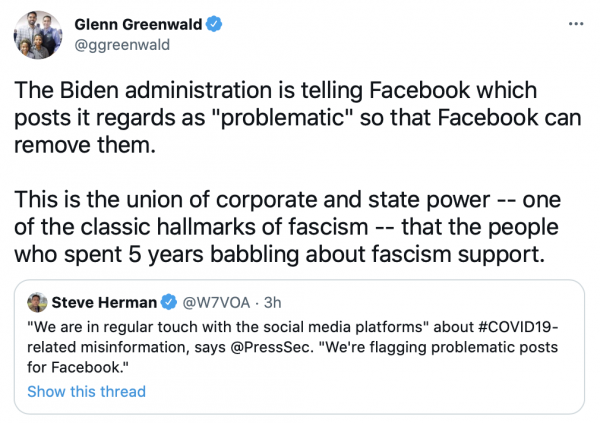

PREDICTION: THEY’RE DOING THIS WITH POLITICAL POSTS, TOO, THEY’RE JUST NOT ADMITTING IT YET:

They’re gonna make people wish that the January 6 “insurrection” was real, and that it had succeeded, aren’t they?

Tax office deputy Mills to retire

Tax Office second commissioner Andrew Mills will leave the job at the end of the year, a year before his term ends.

A spokesman confirmed on Friday that Mr Mills "has decided to retire from the Office of Second Commissioner of Taxation effective 31 December 2019".

Mr Mills is second commissioner responsible for the Tax Office's law design and practice group, including law interpretation and prevention and resolution of disputes.

The office, headed by Commissioner Chris Jordan, has three second commissioners.

The others are Ramez Katf, in charge of technology, and Jeremy Hirschhorn, who has been acting as commissioner responsible for client engagement since December 2018, according to the website.