Overheard in corridors of power

"Always remember, Son, the best boss is the one who bosses the least. Whether it's cattle, or horses, or men; the least government is the best government."

~Ralph Moody

UAE pardons British academic Matthew Hedges convicted of spying

The United Arab Emirates has pardoned and will free a British academic sentenced to life in prison for spying after showing journalists a video of him purportedly saying he was a captain in British intelligence.

'You won't get a single cent': Labor stands firm on stadium cash

NSW Labor will not rebuild either Sydney Football Stadium at Moore Park or proceed with an $800 million upgrade to ANZ Stadium if it wins government at the March election.

Earlier: Trapped In Camelot.

The “Revolving Doors” between politics and big business are corroding democracy in Australia. Secret deals, mates’ deals and the promise of riches after politics all undermine democracy and the power of ordinary citizens. The following investigation of fossil fuel networks in Australia – put together by Adam Lucas and curated by Simone Marsh – is designed to deliver public awareness.

Six weeks after resigning from federal politics in August 2013, former Federal Resources, Energy and Tourism Minister, Martin Ferguson became a board member of British Gas. Ferguson had given approval to BG’s $20 billion Curtis LNG/CSG export project while resources minister in 2010.

In March 2014, he took on a senior role at peak industry lobbyists the Australian Petroleum Production and Exploration Association (APPEA).

Global

Wealth Report 2018: US and China in the lead

Credit Suisse, 2018. Global wealth increased by 14 trillion USD last year – with China ranking second after the USA. Credit Suisse's Global Wealth Report breaks down the world's wealth and analyses the global outlook. The main outcome of the new wealth valuations is confirmation of what many observers already suspected – that China is now clearly established in second place in the world’s wealth hierarchy. Another prominent feature of the world wealth outlook this year is the seemingly relentless rise in household wealth in the United States. In per capita terms, The ranking by median wealth per adult favors countries with lower levels of wealth inequality and produces a slightly different table. This year, Australia (USD 191,450) edged ahead of Switzerland (USD 183,340) into first place.

Credit Suisse, 2018. Global wealth increased by 14 trillion USD last year – with China ranking second after the USA. Credit Suisse's Global Wealth Report breaks down the world's wealth and analyses the global outlook. The main outcome of the new wealth valuations is confirmation of what many observers already suspected – that China is now clearly established in second place in the world’s wealth hierarchy. Another prominent feature of the world wealth outlook this year is the seemingly relentless rise in household wealth in the United States. In per capita terms, The ranking by median wealth per adult favors countries with lower levels of wealth inequality and produces a slightly different table. This year, Australia (USD 191,450) edged ahead of Switzerland (USD 183,340) into first place.

IMF, 2018. The study finds that women, on average, perform more routine tasks than men across all sectors and occupations and tasks that are most prone to automation. Given the current state of technology, we estimate that 26 million female jobs in 30 countries (28 OECD member countries, Cyprus, and Singapore) are at a high risk of being displaced by technology (i.e., facing higher than 70% likelihood of being automated) within the next two decades.

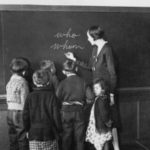

A Crisis Of “Whom”

A few copy editors have proposed a radical solution to the “who/whom” problem: kill off the “whom.” And yet there are those who believe in “whom” and wish to see it used correctly. … Read More

Fernandez, Pablo, 18 topics badly explained by many Finance Professors (October 20, 2018). Available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3270268High score, low pay: why the gig economy loves gamification Business Guardian. JTM: “’I can pay half the working class to kill the other half.’ Not much has changed.”Sackler family members face mass litigation, criminal investigations over opioids crisis Guardian About time.Damages Done: The Longitudinal Impacts of Natural Hazards on Wealth Inequality in the United States Social Problems Oxford Academic“I Hereby Confess Judgment” Bloomberg

“This paper addresses 18 finance topics that are badly explained by many Finance Professors. The topics are: 1. Where does the WACC equation come from? 2. The WACC is not a cost. 3. The WACC equation when the value of debt is not equal to its nominal value. 4. The term equity premium is used to designate four different concepts. 5. Textbooks differ a lot on their recommendations regarding the equity premium. 6. Which Equity Premium do professors, analysts and practitioners use? 7. Calculated (historical) betas change dramatically from one day to the next. 8. Why do many professors still use calculated (historical) betas in class? 9. EVA does not measure Shareholder value creation. 10. The relationship between the WACC and the value of the tax shields (VTS). 11. Beta and CAPM do not explain anything about expected or required returns. 12. Difference between the expected and the required rates of return. 13. It has been very easy to beat the S&P500 in 2000-2018. 14. Apply the logic principle “Never buy a hair growth lotion from a man with no hair” to your investment advisors… and to your professors. 15. Rational investing in equities. 16. Volatility is a bad measure of risk. 17. About the unhelpfulness of the Sharpe ratio. 18. Common errors in portfolio management and wrong advices.”