Report uncovers tax records showing Trump's China plans and deductions

I picked this up from the Fair Tax Mark, and I think it worth sharing. The information comes from this year's Business In The Community Insights Report, admittedly published a few months ago now, but still relevant.

As they note:

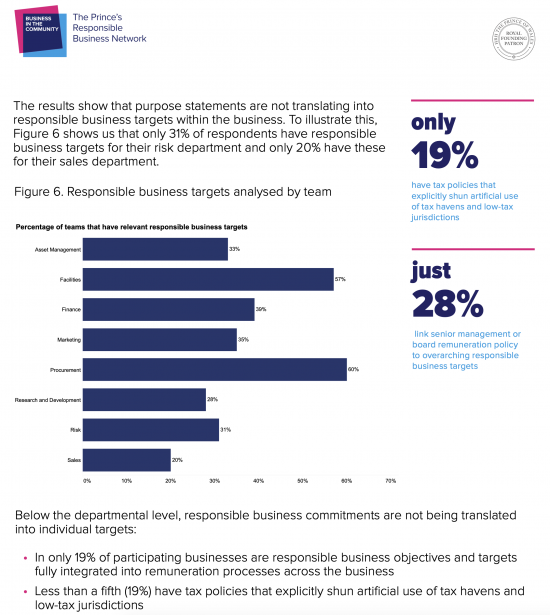

And then they note:

Less than a fifth of companies have a tax policy that explicitly shuns tax haven use, which is a good sign of the number who will also be shunning tax avoidance.

The only fair thing to say is tat business has a very long way to go before it can be considered ethical.

HMRC represents the interests of big business, and unsurprisingly they get the best deal from it as a result. The time for that to change has arrived.

In my opinion, the tax justice movement in the UK, at least, needs to start addressing some new themes. Those it has been working on have been, and are, important. But there are few signs of new themes being worked on, and there are big ones to address still.

This video looks at one of those themes, which is that our tax authority - HM Revenue & Customs - is not fit for purpose because it does not even try to represent the interests of all taxpayers. And the result is that some get better deals than others. I'd suggest that the day when that should happen has passed.

Via Mary Whisner – “Writer and actor Heidi Schreck, a Wenatchee native who worked in the Seattle theater community, revisits her teenage years and her relationship with the nation’s founding document in a filmed version of her original play “What the Constitution Means to Me” (2020, not rated). The play, which premiered on Broadway, was a Tony Award nominee and a Pulitzer Prize finalist in 2019. (Amazon Prime)”

Now streaming: ‘The Trial of the Chicago 7,’ ‘What the Constitution Means to Me’ and more, Seattle Times (Oct. 14, 2020).

Links to Tony and Pulitzer sites:

- Nominated for two Tony Awards in 2019: best play and best performance by an actress in a leading role.

- Finalist for a Pulitzer Prize for Drama in 2019.”