A CEO’s tale: How demonetisation halved the profits of a multinational company that used no cash The Scroll

Artificial Intelligence Goes All-in …on Texas Hold’em WSJ

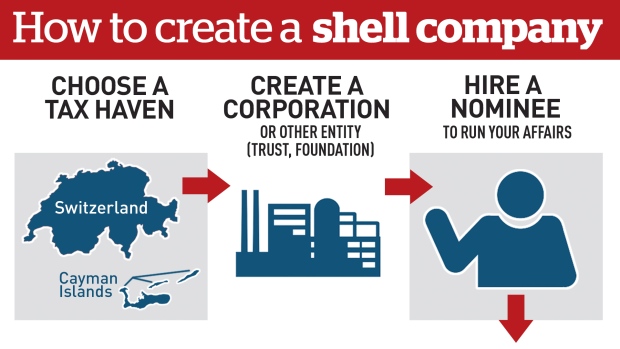

Why would you open a secret company in Panama for legitimate reasons? The Malta Independent

EU Nations Set Up Panels, ‘Mini-Inquiries’ After Panama Leaks Bloomberg BNA

Cutting company tax won't drive investment: Australia Institute Camden Haven Courier

IMF – The secret documents, or how they destroyed Greeks and keep doing it Defend Democracy

Billionaire Peter Thiel makes fortune after ‘sweetheart’ deal with GovernmentNew Zealand Herald

Former Norway PM held at Washington airport over 2014 visit to Iran Guardian

Seattle judge issues nationwide block BBC

New requirement to disclose ultimate beneficial owners of Uruguayan resident and non-resident entities STEP

If we are to have the economy we want we must get rid of tax havens Tax Research UK

Famed tax haven Switzerland chases hidden cash Reuters

"Swiss finance ministry said on Thursday it had reached a deal with Liechtenstein to exchange tax information, potentially helping to uncover billions of dollars in undeclared assets kept by Swiss citizens in neighboring Liechtenstein."

Fuelling Kleptocracy: Transparency in the Extractives Industry Kleptocracy Initiative

Deutsche Bank to Pay Millions in Fines for Helping Wealthy Russians Launder US$ 10 Billion OCCRP

Ireland to get 'majority of Apple €13bn' Irish Independent

'The bulk of €13bn that the European Commission says Apple must pay in back-taxes to undo the benefits of a previous sweetheart tax deal will remain with Ireland, EU Commissioner Margrethe Vestager has said.' See also: Apple has missed the deadline to pay €13bn it owes to the Irish goverment Irish Independent

Canada / Barbados: tax breaks ‘unfair’ Nationnews

U.S.: Groups Push for Laws to Fight Anonymous Shell Companies Public News Service

U.S.: Shell company legislation awaits Oregon lawmakers KGW

U.S. Treasury Secretary-designate Mnuchin’s Offshore Companies Underscore Need to Tackle Tax Havens in Tax Reform FACT Coalition

Accounts in Luxembourg: Billionaire French senator barred from office over tax fraud Luxemburger Wort

EU Committee on Economic and Monetary Affairs - Committee of Inquiry to investigate alleged contraventions and maladministration in the application of Union law in relation to money laundering, tax avoidance and tax evasion

Live stream 31 Jan at 9.30am (Brussels time)

Africa: Accelerated Agenda on Illicit Financial Flows Global Alliance for Tax Justice

Shell companies: How Russia sold its oil jewel: without saying who bought it Reuters

"Like many large deals, the Rosneft privatization uses a structure of shell companies owning shell companies, commonly referred to in Russia as a "matryoshka", after the wooden nesting dolls that open to reveal a smaller doll inside."

Cayman: beneficial ownership, lawyers’ rules up for debate Cayman Compass

"The beneficial ownership register will not be made public in Cayman, according to government ministers"

UK government says ‘no’ to crown dependencies public registers International Investment

Switzerland charges man with selling bank's client data to Germany Reuters

Beyond Panama: Big Accountants, Banks, Law Firms in 'Systematic' Tax Ring Sputnik International

Cites TJN's chief executive Alex Cobham

Professionals who have turned corruption into a global phenomenon Financial Times (paywall)

Germany: Chancellor Merkel Takes on Starbucks in Bashing Over Unfair Tax Practices Bloomberg

Swiss vote on multinational tax perks in February referendum Reuters

PwC nets €600,000 in State fees for Apple probe Irish Independent

UK Prime Minister May must crack down on tax-avoiding millionaires, lawmakers warn Bloomberg

UK Parliament demands crackdown on image rights 'tax avoidance' STEP

'John Doe' disclosure notice served on U.S. owner of Panamanian firm STEP

How do tax evasion and tax avoidance create economic and social inequality? Tax Research UK

Not Being Able To Swiss Bank Anymore A Real Drag On Big Swiss Bank DealBreaker