Selective Searching Panama Papers

Panama papers all revelations so far data leaks

* How Mossack Fonseca worked with Australian clients linked to tax investigations

The Panama–based law firm carried on doing business with Australians after they were linked to some of Australia’s most prominent tax avoidance cases.

Read the full story here

Eight years ago, business guru Marianna Olszewski had a problem. The author of Live it, Love it, Earn it (A Woman’s Guide to Financial Freedom) offers financial advice directed at American women. Some of her personal fortune had been invested using a secret offshore company.But in 2008, at the height of the financial crisis, she decided she wanted to get her $1.8m back. The problem was that the bank that held the funds wouldn’t release the cash without knowing who was behind the offshore company – and Ms Olszewski was desperate to keep her identity secret.Mossack Fonseca was willing to help. It offered to provide somebody who would pretend to be the real – or beneficial – owner of the cash.An email from a Mossack executive to Ms Olszewski in January 2009 explained how she could deceive the bank: “We may use a natural person who will act as the beneficial owner… and therefore his name will be disclosed to the bank. Since this is a very sensitive matter, fees are quite high.”She replied: “I do think we should go ahead with the natural person however I want to have your promise that you… will handle this in the most sensitive manner.”So Mossack Fonseca hired an impostor to pretend to be the beneficiary of the account holding Ms Olszewski’s money:The “natural person” Mossack Fonseca offered turned out to be a 90-year-old British citizen.Mossack Fonseca told Ms Olszewski that the service would be expensive because it was so sensitive. Fees were normally $30,000 (about £20,000 at the time) for the first year and $15,000 for every subsequent year. But she was offered a discount – just $10,000 for year one and $7,500 for every year after.One reason for the high cost is likely to have been the degree of deception. Another email from Mossack details what would be involved:“We need to hire the Natural Person Nominee, pay him, make him sign lots of documents to cover us, make him sign resignations, make him get some proofs evidencing that he has the economic capacity to place such amount of moneys, letters of reference, proof of domicile, etc, etc.”It’s a blatant breach of anti-money laundering rules, but Ms Olszewski signed up anyway.

Now then: if Mossack Fonseca have been doing that in any scale, for at least the last 8 years, tracing American nationals in the leak, or any other nationality, for that matter, is going to be quite tough.

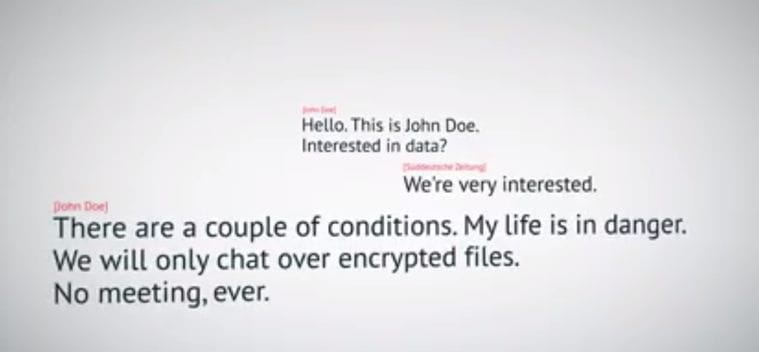

Panama papers-why critic Craig Murray needs the scorecard before he-can name the playersWire: How Reporters Pulled Off the Panama Papers, the Biggest Leak in Whistleblower History

International Consortium of Investigative Journalists, The Panama Papers: Politicians, Criminals and the Rogue Industry That Hides Their Cash

International Consortium of Investigative Journalists, The Panama Papers: Stairway to Tax Heaven

Forbes, Panama Papers Expose Celebs, Politicians, Billionaires With Offshore Tax Havens Despite FATCA

The Guardian, The Panama Papers: How the World’s Rich and Famous Hide Their Money Offshore

New York Times, Panama Law Firm’s Leaked Files Detail Offshore Accounts Tied to World Leaders

Vox, Panama Papers: A Massive Document Leak Reveals a Global Web of Corruption and Tax Avoidance

Wall Street Journal, Panama Leaked Files Spark Angry Reaction in Moscow

Washington Post, Putin Associates Had $2 Billion in Offshore Accounts, Report Says

5. Why aren’t there more Americans in the Panama Papers? And Henry’s primer on tax havens. And Cass Sunstein on the same. There is some evidence this kind of tax evasion is declining (NYT). - See more at: http://marginalrevolution.com/#sthash.QRjhVBNF.dpuf

Why aren’t there more Americans in the

Panama Papers? And Henry’s primer on tax havens.

And Cass Sunstein on the same.

There is some evidence this kind of tax evasion

is declining (NYT)

- Panama Papers: Obama, Clinton Pushed Trade Deal Amid Warnings It Would Make Money Laundering, Tax Evasion Worse International Business Times

- France, Spain, US launch probes over Panama Papers Politico. The US loves busting foreign banks over money laundering, and HSBS and UBS are up to their eyeballs in this scandal.

Panama Papers: Icelandic Pirate Party ‘ready’ to form part of government in event of snap election Independent (Chuck L)

CODA: It’s Been 25 Years Since Restaurant Workers Got a Raise TruthOut

5 ways the Panama Papers swept up EU figures Politico

Here’s Why You Should Give a Shit About the Panama Papers Vice (resilc)

After Panama papers leak: U.S., Britain are eager for names McClatchy (Jason). The names in the database will be released in May.