Big Four accounting firms dodge a bullet

The Tax Office’s grand plan to rein in wayward tax advisers is now all about self-regulation. What could go wrong?

Neil ChenowethSenior writerTax Commissioner Chris Jordan’s bold attempt to regulate Australia’s more creative tax advisers ended quietly last month with an agreement that is so good for Big Four firms they are barely talking about it.

They must hardly believe their luck. The Large Market Tax Adviser Principles (LMTAP) grew out of ATO frustration in 2019 over the black economy, concern which extended to some advisers at Big Four firms promoting hyper-aggressive tax schemes.

A former US partner says EY ignored its own code of conduct when she was sidelined after refusing to sign off on what she claims were client transactions that violated tax and securities laws. EY denies the claims. Will Willitts

The government argued such firms should not be granted government consultancy contracts unless they passed a certification scheme.

After three years of ATO prodding, the Big Four firms came up with an admirable set of principles (it’s on their websites if you look hard enough). The ATO says the LMTAP is the first of its kind in the world, and will “provide their clients, the community, Government and the ATO with confidence that they are not supporting tax avoidance”.

It’s voluntary self-regulation. Each year the firms will make a statement assuring everything is tickety boo. Every three years it will be reviewed by an external party “or an internally qualified party acting independently”.

What could go wrong? A lawsuit against EY in the US offers some possibilities.

Back in June, EY agreed to pay $US100 million to the Securities and Exchange Commission after hundreds of its auditors cheated on ethics exams. Now a former partner claims EY ignored its own code of conduct when she was forced out for refusing to sign off on client transactions that she says violated tax and securities laws.

Sayantani Ghose, described as one of the top transfer pricing experts in the US, claims in a new lawsuit that, since 2009, an unnamed energy company made more than $US20 billion in intercompany loans to its US holding company.

The borrower paid a high interest rate (tax deductible in the US) because it was given a credit rating nine notches lower than its parent, based on what she said was the wrong model and suspect data.

In 2020 her team calculated the US borrower overpaid interest by up to $US3.9 billion in total, and the IRS could impose a tax adjustment of between $US708 million and $US912 million. Under US tax laws the company needed to make a provision of $US800 million against the IRA findings, she said, to keep shareholders informed, but the company refused, adamantly insisting its position was correct.

She describes how EY referred the matter to a string of other partners before finding someone without relevant expertise to sign off on the client’s preferred position.

In a second case, a German company before spinning off a US subsidiary required it to terminate a $US1.7 billion loan, and then to pay a $US721 million make-up fee for paying out the loan early, picking up a $US180 million tax benefit in the US.

The make-up fee was almost 10 times what it should have been, Ghose’s team concluded. Eventually, another partner signed off on it, at the urging of EY Germany, on the client’s preferred terms.

Ghose was later terminated. She’s now in Washington DC with KPMG (the rival firm that, er, also cheated on ethics exams). EY says these are “baseless legal claims”, that Ghose’s concerns were fully reviewed and found to lack merit, and that the US Department of Labor dismissed an administrative complaint by Ghose.

Nothing like this could happen in Australia because, well, LMTAP. The Tax Office has said stop. If you press them, they may say stop again.

The country’s most expert opinion and analysis. Sign up to our weekly Opinion newsletter.

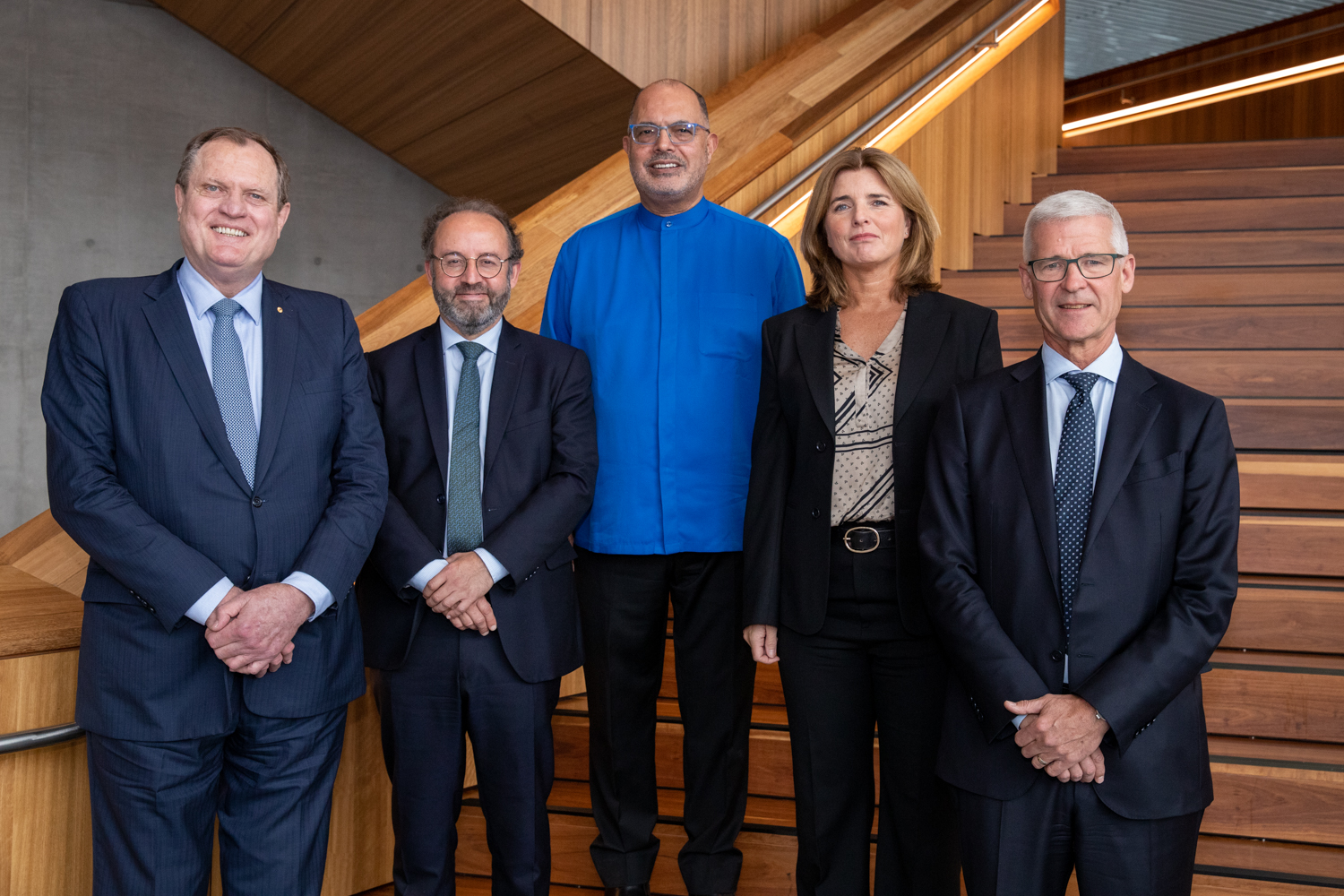

Tax chiefs meet in Sydney to address multinational tax issues