THIS month Gerhard Schröder starts a new job. Shareholders in Rosneft, a Russian energy giant with a market value of nearly $60bn, are set to appoint Germany’s ex-chancellor as a board director on September 29th. Russia’s government, Rosneft’s majority-owner, nominated Mr Schröder, who is pals with Vladimir Putin. Despite Western sanctions imposed on the firm after Russia’s invasion of Ukraine in 2014, Mr Schröder’s move is no surprise. He has worked for years with Gazprom, another energy arm of the Russian state, to promote a gas pipeline to western Europe.

His ties to Russia win him few friends at home. His successor as Germany’s leader, Angela Merkel, calls his behaviour “not OK”. She also vows to reject offers of “any posts in industry once I am no longer chancellor”. Other politicians are happier to follow Mr Schröder’s example. It emerged last month that a former German president, Christian Wulff (pictured), is also employed by a foreign company. He advises...Why do European companies bother to hire ex-politicians?

Another ‘breach of trust’ at STAT: patient who praised TV drug ads says pharma PR company asked her to write op-ed Health News Review

Australian business leaders do not need to look far into the future to see the newest wave of digital disruption headed towards them. Analytics and exponentials technologies are all around us, but are Australian businesses ready?

The post Is your board ready for the robots? appeared first on Blog | Deloitte Australia

Do

public servants know satire when they see it?

The federal government wants to bring in stiff new criminal penalties for impersonating any kind of Commonwealth entity, in addition to an existing prohibition on pretending to be a public official.

The federal government wants to bring in stiff new criminal penalties for impersonating any kind of Commonwealth entity, in addition to an existing prohibition on pretending to be a public official.

While the Federal Trade Commission can impose fines on Equifax for security breaches, they have been in the wet noodle lashing category. As the New York Times pointed out last week:

Non-bank companies, like the credit bureaus, generally are scrutinized only after something has gone wrong...

Edward Kleinbard (USC), The Right Tax at the Right Time, 20 Fla. Tax Rev. ___ (2017):

The companion paper to this (Capital Taxation in an Age of Inequality, 90 S. Cal. L. Rev. 593 (2017)) argues that a moderate flat-rate (proportional) income tax on capital imposed and collected annually has attractive theoretical and political economy properties that can be harnessed in actual tax instrument design. This paper continues the analysis by specifying in detail how such a tax might be designed.

- EU plans rule change to increase taxes on online giants (7 Sep 2017)

- Tesco criticised for deducting £3.4m from plastic bag tax charity donations(7 Sep 2017)

- Labour claims hundreds of schools could have been built with tax avoidance cash(7 Sep 2017)

Southern Gas Corridor is the missing piece of Azerbaijani Laundromat puzzle (7 Sep 2017) 'No one suspects Scotland': UK shell companies allegedly funneled $2.9 billion out of Azerbaijan (7 Sep 2017) - OECD BEPS Action 13 on Country-by-Country Reporting : Guidance on the appropriate use of information contained in Country-by-Country reports (7 Sep 2017)

- UK House of Commons Debate on Taxation and Finance Bill 2017(7 Sep 2017)

- Government should cut Bank of Ireland out of Post Office bank (7 Sep 2017)

- DFS Fines Habib Bank and Its New York Branch $225 Million for Failure to Comply With Laws and Regulations Designed to Combat Money Laundering, Terrorist Financing, and Other Illicit Financial Transactions (7 Sep 2017)

- Cutting taxes on profits earned abroad would be a pointless giveaway (7 Sep 2017)

- UK Government finalises guidance on new corporate 'failure to prevent' tax evasion offences (7 Sep 2017)

- Estonian Presidency to present the boldest plan to date against tax avoidance(7 Sep 2017)

- Trump promotes his tax plan with major falsehood about US taxes (7 Sep 2017)

- Mattioli Woods sets aside £900k for HMRC in-specie tax fight (7 Sep 2017)

- G20 tax haven list 'incomprehensible' (7 Sep 2017)

- Norway defends tax deductions on Arctic drilling (7 Sep 2017)

- Takeshi's Castle star uses video to promote tax scheme (7 Sep 2017)

- AICPA Issues Recommendations on IRS Accounting Method Change (7 Sep 2017) <>

- Liberal Democrats to tax the rich in bid to reduce inequality and steal Labour voters(6 Sep 2017)

- Bill Gates' Plan to Tax Robots Could Become a Reality in San Francisco (6 Sep 2017)

- Thames Water raised loans through a subsidiary in the Cayman Islands (6 Sep 2017)

- We Need Root And Branch Reform, Not More Non-Dom Giveaways (6 Sep 2017)

- The Incredible Shrinking Corporate Tax Bill (6 Sep 2017)

- Brazilian ex-presidents charged in corruption case (6 Sep 2017)

- SPLC Sends Millions to Opaque Offshore Tax Havens (6 Sep 2017)

- Azerbaijan hits back over 'scandalous' money laundering claims (6 Sep 2017)

- The Tories want to enhance non-dom status — it’s a colonial relic and should be abolished (5 Sep 2017)

- UK at centre of secret $3bn Azerbaijani money laundering and lobbying scheme (5 Sep 2017)

- Tax avoidance cost UK economy £13bn in five years, say Labour (5 Sep 2017)

Britain “missed out on 21 hospitals” because of Tory failure on tax avoidance (5 Sep 2017) - France briefing: Taking aim at corporate human rights abuse (5 Sep 2017)

Hundreds of workers risk bankruptcy after using alleged £13m tax avoidance scheme linked to Ultimo founder Michelle Mone (5 Sep 2017) - Michelle Mone's boyfriend linked to £13m offshore tax dodge (5 Sep 2017)

- Country by Country Reports: Who is Exchanging with Whom? (5 Sep 2017)

- Fears mount RBS will have to stump up extra £4bn in US fines(5 Sep 2017)

- IMF: The Benefits and Costs of a U.S. Tax Cut (5 Sep 2017)

- City of Vancouver likes new Airbnb tax in Quebec (5 Sep 2017)

- HMRC Targets the little guy: FTT slams HMRC conduct over ‘unprompted’ VAT claim - a £69 VAT assessment and three penalties of £780, £8.85 and £10.35 (5 Sep 2017)

- Read the Court judgement: GEKKO & COMPANY LTD Appellant v THE COMMISSIONERS FOR HER MAJESTY’S REVENUE & CUSTOMS (5 Sep 2017)

State -aid: Boeing Backed by WTO on $8.7 Billion in Incentives for 777X Jet (5 Sep 2017) - Public sector locums take shelter with risky tax umbrella firms (5 Sep 2017)

CBA reshapes board as money laundering scandal bites (5 Sep 2017) - CBA shareholders set to be major victims of money-laundering scandal(5 Sep 2017)

- What Pricing Tells Us About the Nature of the Smuggling Business (5 Sep 2017)

- Rwanda police arrest critic of president for forgery, tax evasion (5 Sep 2017)

- Stemming the spills: Guiding Framework for National Tax Spillover Analyses (4 Sep 2017)

Manchester United players probed by taxman as HMRC opens investigations into at least two football stars (4 Sep 2017) - Proper carbon tax could wipe billions from polluters' profits (4 Sep 2017)

- Labour to hire army of tax inspectors to claw £36bn a year back from dodgers(4 Sep 2017)

- HMRC: UK Tax avoidance litigation decisions - 2016 to 2017 (4 Sep 2017)

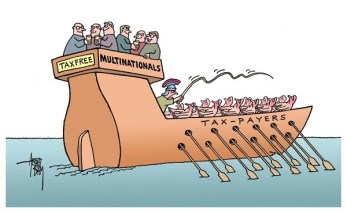

- Big tax gap between individuals and corporations invites abuse (4 Sep 2017)

- It's a Myth That Corporate Tax Cuts Mean More Jobs (4 Sep 2017)

- Danes pay the highest taxes in the world – but a drastic change is coming (4 Sep 2017)

- Cambodia Daily newspaper closes in government tax row (4 Sep 2017)

- The UK government's proposals will do little to check fat-cattery or improve corporate governance (1 Sep 2017)

- Four UK laws, including one on tax avoidance/evasion, coming into force in September you need to know about (1 Sep 2017)