How does your super compare to others on the same income?

And if yours falls short, we outline what you can do to get on track. Hannah Wootton Reporter Jan 2, 2024

Australians have been asked to “compare the pair” of the superannuation balances of two individuals on the same income since the industry fund movement launched its flagship advertising campaign of the same name in 2005.

Across TVs, billboards and radio ads, consumers saw how two workers on the same income could retire with drastically different super balances depending on which fund they were with.

Anyone over 40 who can afford to make concessional contributions to their super should consider doing so, HLB Mann Judd’s Lindzi Caputo says. Oscar Colman But if you “compare the pair” with your own super balance, just how well does it stack up against others on in your income bracket? And what should you do if it falls short?

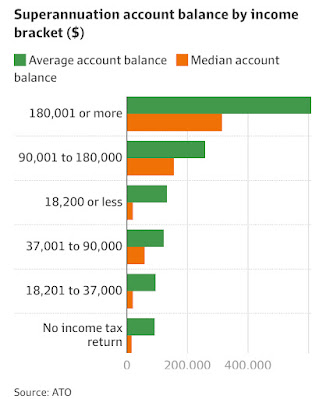

According to the Australian Taxation Office, the biggest super balances unsurprisingly belong to those with the highest incomes.

For those earning over $180,001, the average account balance is around $608,000 while the median is nearly $314,000. This compares to an average of $143,910 and median of $49,413 across all super accounts. Those earning $90,001 to $180,001 have $257,695 on average in their accounts, while those on $37,001 to $90,000 – which accounts for the most individuals with super accounts, nearly 6 million – the average is $121,119.

At lower income thresholds the median is less than $20,000 though the average is far higher, thanks to retirees still having small amounts of taxable income despite large super balances.

Helen Nan says women and small business owners in particular need to check their super balances. Individuals falling short of these averages and medians may need to consider boosting their balances, especially for a particularly comfortable retirement, says Helen Nan, founder of financial advice firm Compound Freedom.

“You might need more than the average or standard super balance if you want to achieve a lifestyle that surpasses the norm,” she adds. “Use retirement-needs calculators or super calculators online to determine how much you need for retirement and how much you need to contribute to achieve your goals.”

According to the Association of Superannuation Funds of Australia, for example, single individuals wanting a comfortable retirement ($51,000 a year) need $595,000 in their super accounts by 67. For couples ($72,000 a year), this is slightly higher at a combined $690,000.

For a modest requirement, both couples ($47,000 a year) and singles ($32,000 a year) would need $100,000.

Extra payments

High-income earners – those earning over $180,000 annually – should aim to hit the maximum individual tax-free balance of $1.9 million in their super by 65 if they want to maintain their standards of living in retirement, says Lindzi Caputo, HLB Mann Judd wealth management director.

This would provide them with an annual tax-free pension of $95,000 based on a 5 per cent drawdown rate. But to get there, they need to maximise their deductable contribution opportunities throughout their working life by contributing the full $27,500 each year.

Having less than $200,000 in super by 40 or less than $500,000 by 50 are signs high-income earners needed to bolster their savings, she adds. For middle-income earners (those on $100,000 to $180,000), these thresholds drop to $100,000 (by 40) and $300,000 (by 50). Caputo recommends savers in this income bracket aim for balances of at least $1 million by 65 to give them a tax-free pension of $50,000 annually.

Again, concessional contributions may be necessary to get there.

Getting to your 40s having made no concessional contributions is also a sign you should bolster your super regardless of your income bracket, says Caputo. These are “a good way to boost super and receive a tax deduction” for those who can afford to make them.

“The return on making extra contributions to super is more than making extra mortgage repayments, where the return is equal to the interest rate being paid,” she says, noting that it also lowers tax bills. Concessional contributions are capped at $27,500 annually, but investors can make use of unused caps from the past five years.

More bang for your buck For those with no cash to spare, Nan recommends consolidating super accounts and changing your investment settings to drive higher returns, perhaps with a higher allocation to growth assets depending on your time horizon.

Salary sacrificing, making non-concessional contributions and getting higher-income spouses to make payments into your super could also help drive up savings.

Nan recommends that women and the self-employed pay “special attention” to their super savings. Women typically have lower super balances thanks to caring responsibilities and the wage gap, she warns, while self-employed business owners often have less or no retirement savings as it is not compulsory for them to contribute to their accounts.

“They often consider their business as their retirement plan, but this doesn’t always work out.”

These individuals need to consider boosting their savings more than the average person in their income bracket, she says, even if it means making tough compromises on other spending.