Last month, The Age and The Sydney Morning Herald revealed the 37-year-old maths whiz from the Sydney suburb of Gordon and graduate of the prestigious St Ignatius College, Riverview was at the centre of the biggest cryptocurrency scandal in the world.

Mr Dwyer and the three founders have also been named in a lawsuit in California that alleges BitMEX went to extraordinary lengths to avoid its own losses, including allegedly confiscating customers’ money, closing out customer positions and faking a hardware outage during a massive rout on the price of bitcoin in early 2020. The claimant, a BitMEX customer, is seeking $US50 million ($66 million) and the return of bitcoins worth $US5 million.

Australian bitcoin mogul remains at large after surrender of boss

In a testament to Aldous Huxley’s astute insight that “all great truths are obvious truths but not all obvious truths are great truths,” the polymathic mathematician Benoit Mandelbrot(November 20, 1924–October 14, 2010) observed in his most famous and most quietly radical sentence that “clouds are not spheres, mountains are not cones, coastlines are not circles, and bark is not smooth, nor does lightning travel in a straight line.”

An obvious truth a child could tell you.

A great truth that would throw millennia of science into a fitful frenzy, sprung from a mind that dismantled the mansion of mathematics with an outsider’s tools.

‘Mr Sin’ aka Abe Saffron had a little mate at ASIO headquarters

Former corruption commissioner blasts NSW cuts to integrity agencies as ‘alarming’

Anthony Whealy says budget cuts to Icac and others will weaken investigations into serious corruption allegations when they should be strengthened

Anthony Whealy says budget cuts to Icac and others will weaken investigations into serious corruption allegations when they should be strengthened

The CRA is watching you: Auditors scouring social media for unreported income from influencers

'If Canadians could figure out how to get paid to play Call of Duty, the CRA needs to figure out how to tax that

He writes of Mandelbrot’s breakthrough:

Over and over again, the world displays a regular irregularity.

[…]

In the mind’s eye, a fractal is a way of seeing infinity.

Imagine a triangle, each of its sides one foot long. Now imagine a certain transformation — a particular, well-defined, easily repeated set of rules. Take the middle one-third of each side and attach a new triangle, identical in shape but one-third the size. The result is a star of David. Instead of three one-foot segments, the outline of this shape is now twelve four-inch segments. Instead of three points, there are six.

Over and over again, the world displays a regular irregularity.

[…]

In the mind’s eye, a fractal is a way of seeing infinity.

Imagine a triangle, each of its sides one foot long. Now imagine a certain transformation — a particular, well-defined, easily repeated set of rules. Take the middle one-third of each side and attach a new triangle, identical in shape but one-third the size. The result is a star of David. Instead of three one-foot segments, the outline of this shape is now twelve four-inch segments. Instead of three points, there are six.

Overview

There has been an accelerated shift towards professional services firms (comprising engineers, accountants, pharmacists, architects, and medical and allied health professions etc) adopting a corporate or hybrid structure (Alternative Structure) in place of the more traditional partnership of natural persons. This shift has created an area of compliance focus for the ATO and a need for taxpayers to have a clear understanding of what constitutes legitimate profit allocation within an Alternative Structure, as distinct from practices that may be inappropriately tax-driven.

Context

Professionals who have an ownership interest in an Alternative Structure commonly become entitled to two types of income distributions in respect of a relevant period:

- an amount representing the value of personal services provided to the firm’s clients (Remuneration); and

- a distribution representing a portion of the value generated by the firm’s business structure, proportionate to their equity interest in the Alternative Structure (Profit Distribution).

The ATO intends to target arrangements that may alter a professional’s tax liability by redirecting income to an associated entity in circumstances where that income may, thematically, be more appropriately attributable to personal services (however, as a technical matter, partnership income does not necessarily comprise a portion of personal services income) – that is, inflating Profit Distribution and understating Remuneration.

Compliance approach

While the ATO retains all its compliance powers in respect of this issue (including Part IVA of the Income Tax Assessment Act 1936 (Cth) (ITAA 1936)), it seems clear that requiring professionals to self-assess is a substantial part of its overall strategy to achieve widespread compliance.

The ATO has released Draft Practical Compliance Guideline PCG 2021/D2 (Draft Guideline) to facilitate self-assessment. The Draft Guideline sets out the details of the regime, which involves two ‘gateway’ tests that must be passed in order for the taxpayer to proceed to the next step, which is self-assessment against a more detailed risk assessment matrix (if the gateway tests are not passed, the taxpayer must engage with the ATO). The aggregated result of the self-assessment then attracts a low, moderate or high risk level. Low risk levels will attract standard ATO compliance treatment. Moderate and high risk arrangements require active engagement with the ATO.

Salaried partners whose remuneration historically comprised, in part, a distribution to an associated entity, fall outside the Draft Guideline and will also no longer be able to take advantage of the safe harbours set out in the 2015 version of the guidelines (which have been superseded by the Draft Guideline). Any person or business involved in such an arrangement will now need to assess their circumstances against the case law arising from Part IVA of the ITAA 1936.

Gateway tests

The gateway tests are designed to capture high risk arrangements and prevent them from proceeding any further in the self-assessment process.

Gateway 1: The arrangement must be commercially driven

There must be a commercial rationale for the arrangement that is documented, assessable and consistent with the economic and structural realities of how the firm operates in practice. For example, a commercial rationale of ‘asset protection’ must deliver a substantive improvement to that variable. Further factors to be considered are as follows:

- the arrangement is not more complex than it needs to be;

- improved tax outcome is not the only benefit of the arrangement; and

- the arrangement is permitted and within the scope of the relevant constituent documents (eg constitution, partnership agreement, internal policies etc).

Gateway 2: Absence of high-risk features

The following arrangements are considered to have high-risk features:

- financing arrangements relating to non-arm’s length transactions;

- exploitation of the difference between accounting standards and tax law;

- arrangements where a partner assigns a portion of a partnership interest in a way that is materially different to the High Court decision in Federal Commissioner of Taxation v Everett [1980] HCA 6 (which involved the permitted assignment of a partnership interest to a related party where the income was deemed to be flowing from the business structure and not from personal services); and

- multiple classes of shares and units held by non-equity holders.

The taxpayer must also have regard to any Taxpayer Alerts released which identify additional arrangements considered to have high-risk features.

Risk assessment

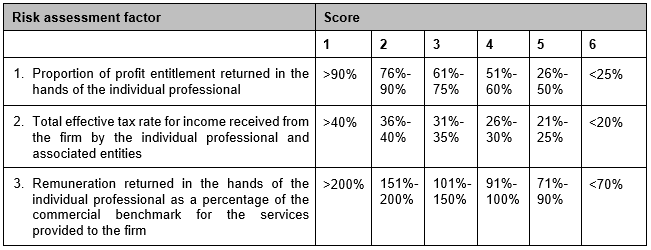

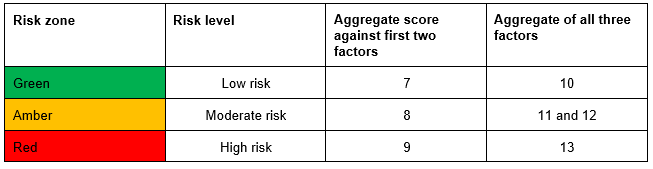

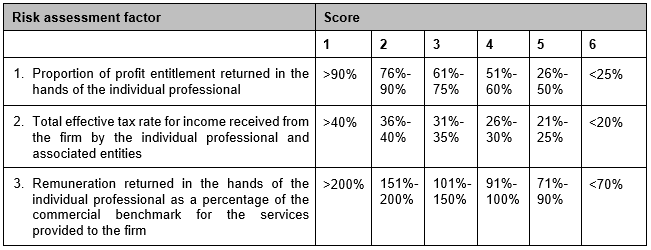

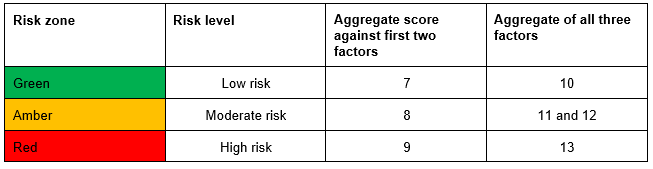

The risk assessment matrix and method of allocating risk level (as set out in the Draft Guideline) are reproduced below. In essence, the more profit that is allocated to the individual professional and the higher the collective effective tax rate of the individual professional and their associated entities, the lower the risk level. However, the 50% Remuneration allocation and 30% effective tax rate ‘safe harbours’ that existed under prior guidelines would generate a risk score of 9, resulting in at least a moderate risk level (although 51% Remuneration allocation and 31% effective tax rate may result in a low risk level).

Matrix

Risk level

Next steps

- The Draft Guideline is not yet in final form (comments close on 26 March 2021) but will most likely be adopted with minimal substantive amendments.

- Firms will typically need to distribute profits in a way that results in at least 51% being received by the individual professional in Remuneration, meaning a 31% or more effective tax rate for the professional and their associated entities.

- It is essential for adequate compliance that all professional services firms take steps to:

- apply a tax planning lens to any profit allocation made in respect of the current financial year;

- from 1 July 2021 (or 1 July 2023 if qualifying for the transitional provisions; ie, commercially driven arrangements without high-risk features entered into prior to 14 December 2017):

- undertake a profit allocation risk assessment as set out in the final version of the Draft Guideline;

- document – and compile supporting material to evidence the conclusions of – the risk assessment; and

- implement an annual risk assessment review process.

- Firms should consider whether a broader review of tax compliance in respect of profit allocation practices is required (eg non-recognition of capital gains, avoidance of Division 7A of Part III of the ITAA 1936, income injection to entities with excess losses etc), particularly if there is an intention to engage with the ATO directly in respect of a moderate or high risk arrangement.

Further information

ATO Draft Practical Compliance Guideline PCG 2021/D2 (see: PCG 2021/D2 | Legal database (ato.gov.au))

Questions

For further information regarding the above, please contact the author or any member of our Tax team.

Disclaimer

This information and contents of this publication, current as at the date of publication, is general in nature to offer assistance to Cornwalls’ clients, prospective clients and stakeholders and is for reference purposes only. It does not constitute legal or financial advice. If you are concerned about any topic covered, we recommend that you seek your own specific legal and financial advice before taking any action.

There has been an accelerated shift towards professional services firms (comprising engineers, accountants, pharmacists, architects, and medical and allied health professions etc) adopting a corporate or hybrid structure (Alternative Structure) in place of the more traditional partnership of natural persons. This shift has created an area of compliance focus for the ATO and a need for taxpayers to have a clear understanding of what constitutes legitimate profit allocation within an Alternative Structure, as distinct from practices that may be inappropriately tax-driven.

Context

Professionals who have an ownership interest in an Alternative Structure commonly become entitled to two types of income distributions in respect of a relevant period:

- an amount representing the value of personal services provided to the firm’s clients (Remuneration); and

- a distribution representing a portion of the value generated by the firm’s business structure, proportionate to their equity interest in the Alternative Structure (Profit Distribution).

The ATO intends to target arrangements that may alter a professional’s tax liability by redirecting income to an associated entity in circumstances where that income may, thematically, be more appropriately attributable to personal services (however, as a technical matter, partnership income does not necessarily comprise a portion of personal services income) – that is, inflating Profit Distribution and understating Remuneration.

Compliance approach

While the ATO retains all its compliance powers in respect of this issue (including Part IVA of the Income Tax Assessment Act 1936 (Cth) (ITAA 1936)), it seems clear that requiring professionals to self-assess is a substantial part of its overall strategy to achieve widespread compliance.

The ATO has released Draft Practical Compliance Guideline PCG 2021/D2 (Draft Guideline) to facilitate self-assessment. The Draft Guideline sets out the details of the regime, which involves two ‘gateway’ tests that must be passed in order for the taxpayer to proceed to the next step, which is self-assessment against a more detailed risk assessment matrix (if the gateway tests are not passed, the taxpayer must engage with the ATO). The aggregated result of the self-assessment then attracts a low, moderate or high risk level. Low risk levels will attract standard ATO compliance treatment. Moderate and high risk arrangements require active engagement with the ATO.

Salaried partners whose remuneration historically comprised, in part, a distribution to an associated entity, fall outside the Draft Guideline and will also no longer be able to take advantage of the safe harbours set out in the 2015 version of the guidelines (which have been superseded by the Draft Guideline). Any person or business involved in such an arrangement will now need to assess their circumstances against the case law arising from Part IVA of the ITAA 1936.

Gateway tests

The gateway tests are designed to capture high risk arrangements and prevent them from proceeding any further in the self-assessment process.

Gateway 1: The arrangement must be commercially driven

There must be a commercial rationale for the arrangement that is documented, assessable and consistent with the economic and structural realities of how the firm operates in practice. For example, a commercial rationale of ‘asset protection’ must deliver a substantive improvement to that variable. Further factors to be considered are as follows:

- the arrangement is not more complex than it needs to be;

- improved tax outcome is not the only benefit of the arrangement; and

- the arrangement is permitted and within the scope of the relevant constituent documents (eg constitution, partnership agreement, internal policies etc).

Gateway 2: Absence of high-risk features

The following arrangements are considered to have high-risk features:

- financing arrangements relating to non-arm’s length transactions;

- exploitation of the difference between accounting standards and tax law;

- arrangements where a partner assigns a portion of a partnership interest in a way that is materially different to the High Court decision in Federal Commissioner of Taxation v Everett [1980] HCA 6 (which involved the permitted assignment of a partnership interest to a related party where the income was deemed to be flowing from the business structure and not from personal services); and

- multiple classes of shares and units held by non-equity holders.

The taxpayer must also have regard to any Taxpayer Alerts released which identify additional arrangements considered to have high-risk features.

Risk assessment

The risk assessment matrix and method of allocating risk level (as set out in the Draft Guideline) are reproduced below. In essence, the more profit that is allocated to the individual professional and the higher the collective effective tax rate of the individual professional and their associated entities, the lower the risk level. However, the 50% Remuneration allocation and 30% effective tax rate ‘safe harbours’ that existed under prior guidelines would generate a risk score of 9, resulting in at least a moderate risk level (although 51% Remuneration allocation and 31% effective tax rate may result in a low risk level).

Matrix

Risk level

Next steps

- The Draft Guideline is not yet in final form (comments close on 26 March 2021) but will most likely be adopted with minimal substantive amendments.

- Firms will typically need to distribute profits in a way that results in at least 51% being received by the individual professional in Remuneration, meaning a 31% or more effective tax rate for the professional and their associated entities.

- It is essential for adequate compliance that all professional services firms take steps to:

- apply a tax planning lens to any profit allocation made in respect of the current financial year;

- from 1 July 2021 (or 1 July 2023 if qualifying for the transitional provisions; ie, commercially driven arrangements without high-risk features entered into prior to 14 December 2017):

- undertake a profit allocation risk assessment as set out in the final version of the Draft Guideline;

- document – and compile supporting material to evidence the conclusions of – the risk assessment; and

- implement an annual risk assessment review process.

- Firms should consider whether a broader review of tax compliance in respect of profit allocation practices is required (eg non-recognition of capital gains, avoidance of Division 7A of Part III of the ITAA 1936, income injection to entities with excess losses etc), particularly if there is an intention to engage with the ATO directly in respect of a moderate or high risk arrangement.

Further information

ATO Draft Practical Compliance Guideline PCG 2021/D2 (see: PCG 2021/D2 | Legal database (ato.gov.au))

Questions

For further information regarding the above, please contact the author or any member of our Tax team.

Disclaimer

This information and contents of this publication, current as at the date of publication, is general in nature to offer assistance to Cornwalls’ clients, prospective clients and stakeholders and is for reference purposes only. It does not constitute legal or financial advice. If you are concerned about any topic covered, we recommend that you seek your own specific legal and financial advice before taking any action.

Tax Return of the Jedi

- “There are reasons to think that the view from the deathbed is worse, not better, than the view from the midst of life” — Neil Levy (Oxford) on the idea that those close to death have special insight into what makes for a good life

- What’s good about philosophy and what philosophy is good at — a conversation with me about these and related issues on “Brain in a Vat”

- Can you name an ancient woman philosopher? Great. Now name five more. — Dawn LaValle Norman (Australian Catholic) can help you out

- Coming soon: a tool for the accurate machine-reading of medieval Latin texts — learn more about it and attend a training session on how to use it this week (via Bob Pasnau)

- Perhaps it should have been “Immanuel and the Purple Crayon” — Marshall Thompson (FSU) looks at philosophical themes in children’s books

- “He’s got the instincts of a grand unifier” and “the heart of a multiplier” — the fascinating ideas of Spinoza, discussed in an interview with Sam Newlands (Notre Dame)

- “When Harvard’s administrators tell Professor West that they cannot bring him up for tenure because it’s ‘too risky’ and he’s ‘too controversial,’ they completely undermine the point of tenure” — Robin D. G. Kelley (UCLA) on Cornel West, tenure, and Harvard