The Psychology of Social Media Addiction - Cloudnames blog

The surprisingly successful addict. During her battle with alcohol, Leslie Jamison got prestigious degrees, sold a novel, and took the world by storm

After Retiring From The IRS At 58, Dorothy Steel Started Acting At 88 And Hit It Big At 92 In 'Black Panther'

*The cost of privilege

This research, commissioned by Anglicare Australia, shows that each year, a staggering $68 billion in taxpayer dollars, greater than the cost of Newstart, disability support, or any other benefit, is spent keeping the wealthiest Australian households wealthy

Pecuniary penalties for competition law infringements in Australia 2018

This report compares Australia's pecuniary sanctions regime for competition law infringements to that of a number of other major OECD jurisdictions. Pedro Caro de Sousa, Sean Ennis, Semin Park

Raj Chetty of Harvard University and Emmanuel Saez of University of California (UC), Berkeley, created a big media splash last summer with a study showing that social mobility—the income status of adult children relative to their parents—correlates with where the children grew up. The study, based on an analysis of millions of U.S. tax records that had been largely off-limits to researchers, has fed the public perception that the American dream of equal opportunity for all may be fading. It also bolstered the reputations of the two young superstars—each has received the top prize for economists under 40 and a MacArthur “genius” award. And it has left their colleagues wondering how they pulled off such a feat.

“It was very entrepreneurial of them to get access to the data, which is not normally available,” says Gary Solon, an economist at Michigan State University in East Lansing who has done pioneering work on social mobility using small data sets from surveys, the traditional approach to studying the topic. “You need the energy and perseverance and connections. My guess is that it was probably some combination of skill and luck.”

“It was very entrepreneurial of them to get access to the data, which is not normally available,” says Gary Solon, an economist at Michigan State University in East Lansing who has done pioneering work on social mobility using small data sets from surveys, the traditional approach to studying the topic. “You need the energy and perseverance and connections. My guess is that it was probably some combination of skill and luck.”

|

|

*Slovak PM resigns after journalist’s murder OCCRP

‘Prime Minister Robert Fico resigned … following mass protests and political turmoil over the murder of a journalist who delved into corruption and links between organized crime and politics.’

Tax Commissioner Chris Jordan offends accountants with rort comments

Australian Tax Office cracking down on holiday home owners ...

Secret BCA commitment to Senate shows members ...

The secret vow, which has emerged in the midst of the business blitz on the Senate crossbench to pass the Turnbull government's company tax cuts, would bind the likes of Qantas, Fortescue and BHP to "pay our tax and show our commitment by signing the ATO's tax transparency standard."

|

|

The Elephant Always Forgets: U.S. Tax Reform and the WTO, by Reuven Avi-Yonah (Michigan) & Martin Vallespinos (S.J.D. 2018, Michigan)

James R. Repetti (Boston College) presents Tax Rates, Efficiency and Inequality at BYU today as part of its Tax Policy Colloquium Series hosted by Cliff Fleming and Gladriel Shobe:

Traditionally,

the great democracies of the western world assigned equal weight to

distributive justice and economic efficiency in designing a tax system.

In the past few decades, however, economic efficiency has dominated the

debate about the best design of a tax system in politics and in analysis

by legal academics. Discussions of progressive tax rates often focus on

the adverse efficiency effects of high rates while ignoring benefits

arising from a progressive rate structure’s reduced burden on lower

income individuals. For example, many advocate low tax rates on

investment income to reduce the efficiency effects of taxing savings.

In

an attempt to increase efficiency, individual tax rates have decreased

over the past 60 years. In 1956, the maximum statutory tax rate was 91%.

Currently, the maximum tax rate is 37%. At the same time that tax rates

were reduced, inequality increased, fueled in part by the declining tax

rates.

There are several explanations for the intense focus on efficiency.

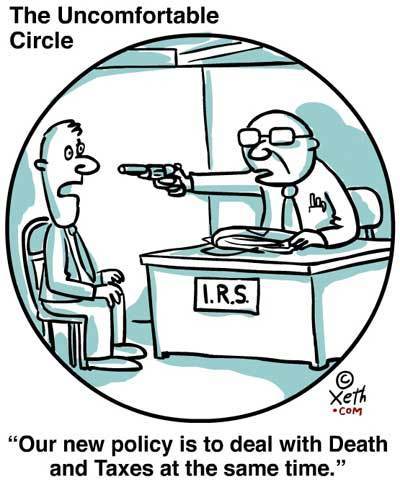

IRS Referrals for Criminal Prosecution Reach New Low

“The latest available data from the Justice Department show that during January 2018 the government reported receiving 135 new referrals for prosecution from the Internal Revenue Service. According to referral-by-referral data obtained by the Transactional Records Access Clearinghouse (TRAC), this number was down substantially from its peak four years ago. For the most recent twelve month period this meant that IRS referred only 1,824 taxpayers for criminal prosecution, compared with the same twelve month period four years ago when it had referred more than twice that number (3,896). http://trac.syr.edu/tracreports/crim/502/.”

Why are corporate penalties for cartels so low in Australia?

Regulation of Beneficial Ownership in Latin America and the Caribbean

My

paper - Andres Knobel - on “Regulation of Beneficial Ownership in Latin

America and the Caribbean” which I wrote for the Inter-American

Development Bank is now available in Spanish and English here. The

paper, published in November 2017, provides an explanation on the

concept, obstacles and … [Read more...]

My

paper - Andres Knobel - on “Regulation of Beneficial Ownership in Latin

America and the Caribbean” which I wrote for the Inter-American

Development Bank is now available in Spanish and English here. The

paper, published in November 2017, provides an explanation on the

concept, obstacles and … [Read more...]

Over

the past decade, a number of well-publicized data leaks have revealed

the secret offshore holdings of high-net-worth individuals and

multinational taxpayers, leading to a sea change in cross-border tax

enforcement. Spurred by leaked data, tax authorities have prosecuted

offshore tax cheats, attempted to recoup lost revenues, enacted new

laws, and signed international agreements that promote “sunshine” and

exchange of financial information between countries.

The

conventional wisdom is that data leaks enable tax authorities to detect

and punish offshore tax evasion more effectively, and that leaks are

therefore socially beneficial from an economic welfare perspective. This

Article argues, however, that the conventional wisdom is too

simplistic.

Miranda Stewart (Australian National University), Redistribution Between Rich and Poor Countries:

The topic of redistribution between rich and poor countries opens a can of worms. This paper first inquires into what we mean by some of these words and second, considers the role of taxation in redistribution. It briefly considers the various modes of redistribution to address poverty and inequality, including the role of taxation, within a country before turning to consider modes of redistribution between rich and poor countries. The paper then turns to consider whether we are asking the right question. Should the question, really, be about redistribution between rich and poor people? In an increasingly global and digital era, how might we reconsider the role of taxation in achieving this?

The topic of redistribution between rich and poor countries opens a can of worms. This paper first inquires into what we mean by some of these words and second, considers the role of taxation in redistribution. It briefly considers the various modes of redistribution to address poverty and inequality, including the role of taxation, within a country before turning to consider modes of redistribution between rich and poor countries. The paper then turns to consider whether we are asking the right question. Should the question, really, be about redistribution between rich and poor people? In an increasingly global and digital era, how might we reconsider the role of taxation in achieving this?

New York Times, A Curveball From the New Tax Law: It Makes Baseball Trades Harder:

As President Trump congratulated the World Series champion Houston Astros at a White House ceremony last week, he also heaped praise on himself and congressional Republicans for passing a sweeping tax cut last year. He hailed Representative Kevin Brady of Texas, the House’s chief tax writer and an Astros superfan, as “the king of those tax cuts.”

Boston College hosted the annual Boston College-Tulane Tax Roundtable on Friday:

James Alm (Tulane), Is the Haig-Simons Standard Dead? The Uneasy Case for a Comprehensive Income Tax

Discussant: Rebecca Kysar (Brooklyn)

Discussant: Rebecca Kysar (Brooklyn)

Thomas Brennan (Harvard), Debt and Equity Taxation: A Combined Economic and Legal Perspective

Discussant: James Repetti (Boston College)

Discussant: James Repetti (Boston College)

Heather Field (UC Hastings), Tax Lawyers as Tax Insurance

Discussant: Natalya Shnitser (Boston College)

The Financial Secrecy Index Identifies the Countries Most Responsible for the Illicit Financial Flows that Facilitate Global Corruption The Global Anticorruption Blog

Tax Justice & Extractives: Toolbox from Latin America Global Alliance for Tax Justice

Authorities seize control of bank at center of Malta corruption scandal The Guardian

‘Maltese authorities took control of Pilatus Bank that is at the center of a scandal exposed by the murdered journalist Daphne Caruana Galizia’ See also:

Malta freezes Pilatus bank’s operations after chairman’s arrest Reuters, Whistleblower fears for life as US arrests Malta bank chair EU Observer

Australian tax justice movement fights Trump-style corporate tax cuts Global Alliance for Tax Justice

Latvia to phase out shell company accounts in banking sector Public Broadcasting of Latvia

ICRICT welcomes the proposal by the European Commission to introduce a digital services tax

See also: Taxation of digital companies: No free ride for Google and Co. Sven Giegold

‘Secret’ tax deals with multinationals soar despite scandals EurActiv

Shell company frontmen could be jailed under UK property transparency plans The Guardian

Slovak PM resigns after journalist’s murder OCCRP

‘Prime Minister Robert Fico resigned … following mass protests and political turmoil over the murder of a journalist who delved into corruption and links between organized crime and politics.’

Swiss charge three Germans in bank secrecy clash Reuters

“This is justice-for-hire, intimidation. It is supposed to tell every European that he will go to jail if he uncovers wrongdoing by a Swiss bank”

Panama Papers Law Firm Mossack Fonseca Closes Its Doors ICIJ

See also: Global Witness Statement on news that Panamanian law firm Mossack Fonseca is to close

Britain set to ban secretive Scottish shell companies to halt flow of dirty Russian money Herald Scotland

Discussant: Natalya Shnitser (Boston College)

The Financial Secrecy Index Identifies the Countries Most Responsible for the Illicit Financial Flows that Facilitate Global Corruption The Global Anticorruption Blog

Tax Justice & Extractives: Toolbox from Latin America Global Alliance for Tax Justice

Authorities seize control of bank at center of Malta corruption scandal The Guardian

‘Maltese authorities took control of Pilatus Bank that is at the center of a scandal exposed by the murdered journalist Daphne Caruana Galizia’ See also:

Malta freezes Pilatus bank’s operations after chairman’s arrest Reuters, Whistleblower fears for life as US arrests Malta bank chair EU Observer

Australian tax justice movement fights Trump-style corporate tax cuts Global Alliance for Tax Justice

Latvia to phase out shell company accounts in banking sector Public Broadcasting of Latvia

ICRICT welcomes the proposal by the European Commission to introduce a digital services tax

See also: Taxation of digital companies: No free ride for Google and Co. Sven Giegold

‘Secret’ tax deals with multinationals soar despite scandals EurActiv

Shell company frontmen could be jailed under UK property transparency plans The Guardian

Slovak PM resigns after journalist’s murder OCCRP

‘Prime Minister Robert Fico resigned … following mass protests and political turmoil over the murder of a journalist who delved into corruption and links between organized crime and politics.’

Swiss charge three Germans in bank secrecy clash Reuters

“This is justice-for-hire, intimidation. It is supposed to tell every European that he will go to jail if he uncovers wrongdoing by a Swiss bank”

Panama Papers Law Firm Mossack Fonseca Closes Its Doors ICIJ

See also: Global Witness Statement on news that Panamanian law firm Mossack Fonseca is to close

Britain set to ban secretive Scottish shell companies to halt flow of dirty Russian money Herald Scotland