Closing asset loophole can raise $100 billion in taxes, Treasury now says

The new estimate doubles what the agency previously said it could recover by preventing certain large businesses from manipulating the taxable value of assets.

By Julie Zauzmer Weil December 4, 2024

The Biden administration has doubled its estimate of how much money it can collect by cracking down on an arcane tax avoidance scheme.

Months after saying it expects to collect at least $50 billion over the next decade by stopping large business partnerships from manipulating the taxable value of assets or depreciating the same assets repeatedly for tax deductions, the Treasury Department has quietly updated its forecast to more than $100 billion.

The IRS’s pledge to go after the practice known as “basis shifting” has made waves among accountants for the largest and most complex business partnerships. Some of them say that the true amount of taxes avoided far dwarfs even the $100 billion figure, though the IRS is unlikely to ever find anywhere close to all of the money.

“The IRS announcements this summer were like a shot across the bow: We’re onto you, and if you try this, the IRS is going to litigate,” said Eric Solomon, a former assistant treasury secretary for tax policy who now works as a tax attorney in private practice. “Deterrence by itself increases revenue.”

Although it is a large increase in the forecast, $100 billion remains a conservative estimate, said a Treasury official who spoke on the condition of anonymity to discuss the department’s scoring process for its initiatives. Data on basis shifting is difficult to come by, he said, but the department updated its estimate based on expert feedback on the prevalence and magnitude of the transactions.

Basis shifting allows complex partnership businesses to shift the value of certain assets, such as land or machinery, by moving assets from one business to another one that are linked entities. The moves can allow the partnership to depreciate the same asset over and over again in some cases, greatly reducing tax bills.

Lawyers and accountants for the partnerships say it is legal, and that Congress could pass a ban if lawmakers want to stop the practice. Biden administration officials view basis shifting for the sole purpose of reducing tax bills as illegal, citing a rule known as the “economic substance doctrine” that says the transactions must have a purpose other than just avoiding taxes.

The dispute might play out in court. Experts are closely watching a U.S. Tax Court case underway, Otay Project LP v. Commissioner of Internal Revenue, in which the IRS contends that a family-owned partnership that built luxury housing developments in Southern California improperly reported hundreds of millions of dollars in basis adjustments, allowing them to avoid taxes on more than $700 million in income from selling the homes.

The home builders, whose lawyers declined to comment, have said in court filings that they did nothing wrong because the transactions had legitimate business purposes beyond avoiding taxes.

Government lawyers say the partnership in the case paid accountants more than $20 million to structure a scheme that used thousands of transactions among related entities.

Some accountants and lawyers for partnerships are skeptical of the government’s ability to prevent such maneuvers. “I think you’re going to find that people are not giving this up so easily,” partnership tax lawyer Stuart Rosow said. “I may be a pessimist, but I think they’re going to have a very tough fight and are going to be tied up in litigation.”

The Biden administration’s crackdown relies on a multipronged approach, including new rules that require partnerships to disclose more of these transactions so it is easier for government auditors to find them.

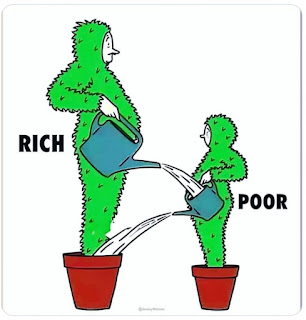

As a structure for large business interests, partnerships boomed in the past two decades while IRS oversight of them shrank. By 2019, the IRS was auditing just 1 in 1,000 partnerships, even as the number of partnerships with more than $10 million in assets grew into the hundreds of thousands, a 70 percent increase during the 2010s.

The 2022 Inflation Reduction Act, which included tens of billions of dollars for the IRS, gave the tax agency resources to improve customer service and enforcement — including more auditors focused on partnerships.

Republicans have tried to claw back the IRS funds repeatedly since, and might succeed in doing so once they control both chambers of Congress next year. But if the Treasury Department’s new $100 billion estimate proves true, cracking down on basis shifting alone would more than pay for the entire allocation of extra money for the IRS.

Some partnership tax experts said they believe the incoming Trump administration and congressional Republicans might favor continuing the enforcement actions against basis shifting or enacting new legislation restricting the practice to raise revenue to fund tax cuts.

“Congress is looking for revenue raisers” to help cover the cost of extending the expiring 2017 Trump tax cuts, said Monisha Santamaria, a partnership tax expert at KPMG who previously worked for Congress’s Joint Committee on Taxation. “Since the basis shifting number has now doubled and the need for revenue can be viewed as great now — you can see how this can enter the 2025 tax menu.”

Republican leaders of the congressional committees overseeing the IRS did not respond to questions from The Washington Post.

Meanwhile, Democrats are drafting a bill that would require closely related entities to pay tax when they make certain basis-shifting transactions, according to a Senate Finance Committee staff member who spoke on the condition of anonymity to discuss conversations about yet-to-be-introduced legislation.

“I think it’s inefficient to rely on the IRS to shut these down case-by-case,” said Miles Johnson, a lawyer formerly in private practice who now focuses on partnership tax issues at the New York University Tax Law Center. “You need some sort of rule fix to turn these off.”

The ongoing audits will keep revealing how partnerships have avoided taxes for years, Johnson predicted.

“Tax administrators and scorers are continuing to develop a robust understanding of what’s going on in the market, how prevalent some of this is, and what the dollars at stake are,” he said. “I wouldn’t be surprised if we saw revenue estimates relating to partnerships just going up all over the place.”