How Corporate Vehicles Conceal Crime and Chicanery

Financial vehicles designed to conceal wealth and questionable activity fuel corruption and crime while allowing perps evade accountability

Filomena Kyriacou - The Snitch: Accountant mentioned in two major tax fraud cases

Nick Bruining: Incredible and unusual places the ATO searches to catch out Aussie tax dodgers

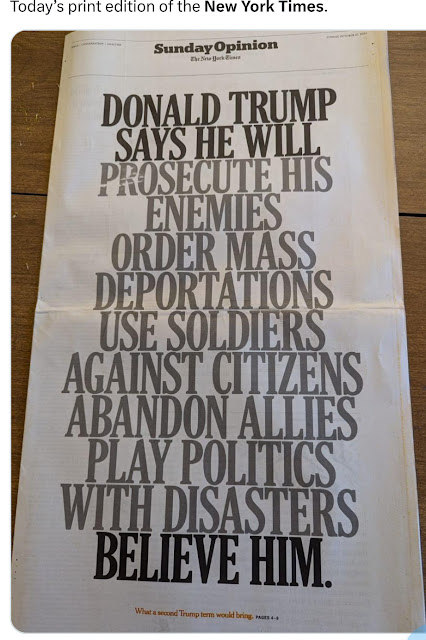

The NY Times Editorial Board: “Donald Trump says he will prosecute his enemies, order mass deportations, use soldiers against citizens, play politics with disasters, abandon allies. Believe him.”

Lawsuit Argues Warrantless Use of Flock Surveillance Cameras Is Unconstitutional 404 Media

What do Harris and Trump gain from all these podcast appearances?

What if honesty really is the best policy in politics? Oren Cass, FT

Mineral Resources executives purchased discounted equipment amid tax probe

The two executives acquired heavy machinery in 2017 for their luxury Halfway Bay Station at rates significantly below market value.

An invoice addressed to Halfway Bay Station listed 13 items, including tractors, excavators, and generators, for a total of $343,000.

Comparisons with current market prices show that similar equipment would cost at least three times that amount today.

For instance, a Caterpillar bulldozer sold for $56,000, but a comparable model is now worth more than five times that figure.

The sale, approved by then-chairman Peter Wade, has surfaced amid investigations into alleged tax evasion involving Ellison.

The Australian Securities and Investments Commission and external counsel are examining an offshore scheme where executives, including Ellison, allegedly profited $7 million between 2006 and 2009 by inflating machinery sales through a British Virgin Islands company.

MinRes chairman James McClements has downplayed concerns, calling the sales a private matter and stating the contracts predated the company’s public listing.

However, the issue continues to draw scrutiny as Roberts denied purchasing equipment below market value, insisting no discounts were requested. Ellison and Roberts co-owned the 18,000-hectare Halfway Bay Station, which they bought in 2016. The property was sold for $NZ30 million ($27 million) in 2022.