Long Covid now major cause of long-term job absence, say quarter of UK employers FT

The world surpasses 400 million known coronavirus cases and confronts how to live with Covid.

Deaths from all causes may have increased in January for the first time during the pandemic, spiking by about 10 per cent as the Omicron variant infected millions of Australians.

Modelling by the Actuaries Institute’s COVID-19 working group shows the 1582 COVID-19 fatalities recorded in January – more than the whole of either 2021 or 2020 – drove up the number of overall deaths without any expected offset from fewer influenza deaths.

IRS’s Struggles With Backlogs Draw Scrutiny From Lawmakers, Taxpayers

The tax agency is reshuffling about 1,200 workers to help clear delayed refunds and correspondence

Sex, lies and trade deals: how a businessman bribed half the US navy RT

Corporate corruption in South Africa demands global action in response FT

A series of stories in an Israeli newspaper about alleged systematic illegal cyber spying by the police against innocent citizens has rattled the Israeli political system.

Illegal domestic cyber spying allegations rattle Israel

Revealed: Millions Of Dollars Of Art Laundered Through Shell Companies

Good News on Crypto Taxation

Suppose you buy an apple tree and it grows apples. You don’t sell any apples. (Maybe you use the apples to plant more trees). The IRS demands that you pay income on market value of the apples even though you haven’t sold any. Crazy! Yet that is how the US taxes staking.

Well it turns out that the IRS agrees with me (!) or at least believes that the courts were likely to side with the argument I sketched. The Proof of Stake Alliancewrites:

[I]n 2020, Abe Sutherland’s 2020 Tax Notesbrief argued that these tokens should be taxed when they are sold, not when they are created – like all property– and that treating this property created by staking as the taxpayer’s immediate income would be contrary to over 100 years of tax law.

The IRS has signaled that it agrees in a new case: After Joshua Jarrett paid income tax on staking rewards he created in 2019, he sued the IRS for a refund. On Thursday, he will announce that the IRS granted this refund. Nevertheless, Josh and the legal team at Fenwick will reject the refund and continue to sue the IRS in order to force the agency to offer explicit guidance that states that staking rewards will be taxed as property, not income. Only through this definitive statement will taxpayers in the growing proof of stake industry be able to plan for their futures.

This case has significant implications for the tax industry, as it will determine how staking rewards are taxed in the future. POSA is supporting and elevating Josh and this case to demand the IRS offer explicit guidance that staking rewards, as property, should be taxed when they are SOLD, not when they are created.

Assuming this falls into place, as looks likely, this offers significant clarity to current tax law on crypto. Note that this does not mean that crypto is taxed less–it is still taxed when sold–it’s more about creating simplicity and consistency in the code. See also Tyler’s post, We need a better tax system for crypto.

Special congratulations to Abe Sutherland.

Bloomberg, Tax-Free Inheritances Fuel America’s New $73 Trillion Gilded Age:

Almost half of all U.S. wealth transferred over the next quarter century will come from the top 1.5% of households.

Americans can expect to inherit $72.6 trillion over the next quarter century, more than twice as much as a decade ago, in the latest indication of how soaring markets are poised to bolster the next generation of the ultra-rich.

TechRepublic: “Psychiatrists earn more ($252,385), and real estate agents and corporate recruiters have higher job satisfaction scores (4.4 out of 5).

Despite that stiff competition, an IT job took the top spot in Glassdoor’s annual list of the top jobs in the U.S. Enterprise architects are number 1, followed by full-stack engineers, data scientists, devops engineers and strategy managers. IT jobs rounded out the rest of the top 10, but people-centric jobs made significant progress this year with psychiatrist and psychologist entering the list for the first time at #22 and #34.

HR manager is in the number 13 spot this year, with corporate recruiter at 17 and HR business partner at 39. Corporate recruiters were at number 46 last year. Richard Johnson, associate economist at Glassdoor, said the presence on the list of these people centric jobs shows that companies are prioritizing hiring people as well as creating fulfilling work environments. “It takes top talent to find top talent,” he said. Johnson said the enterprise architect job moved up from the number three spot in 2021 due to the job’s high earning potential, wide availability for remote workers and high job satisfaction.

The ratings are a combination of three factors for each position: job satisfaction, number of openings and median base salary. Here is what the top 10 list looks like for 2022…”

Is your job at the top of the Glassdoor best jobs 2022 list? If not, try one that is - TechRepublic

Financial Regulation: Systemic Risk, February 1, 2022: “The U.S. financial system has experienced two major episodes of financial instability in the 21stcentury (as well as a few minor incidents)—the 2007-2009 financial crisis and instability surrounding the onset of the COVID-19 pandemic in the spring of 2020. In both cases, the federal government and the Federal Reserve responded by extending, on an overwhelming scale, financial assistance to financial markets and institutions to restore stability. Although the government generally recouped principal and interest on this assistance after markets stabilized, trillions of taxpayer dollars were pledged

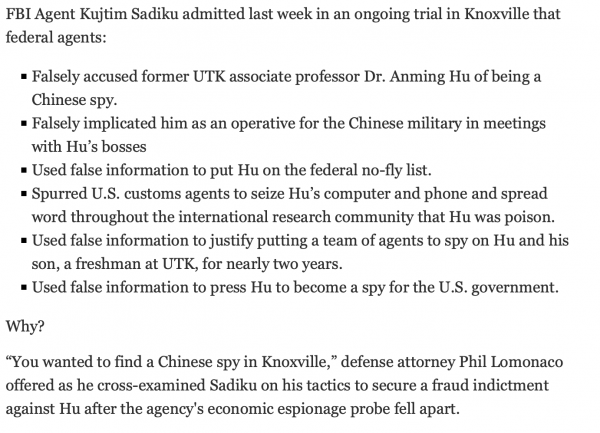

THE BEHAVIOR OF THE FBI AND THE JUSTICE DEPARTMENT IN THIS CASE WAS DISGRACEFUL: UT professor cleared of charges in failed federal case goes back to work.

Flashback: Trial reveals federal agents falsely accused a UT professor born in China of spying.

And congratulations to Phil Lomonaco on a stellar bit of representation. This is what criminal defense lawyers are for.

UPDATE: From the comments:

In all seriousness, there are likely hundreds, if not thousands, of legitimate, bona-fide Chinese spies in this country, and the Feebs could be spending their resources chasing those guys.

But no, the FBI has to go around framing innocent people, which is going to make prosecuting actual spies just that much harder.

Clown world.