The UK needs a new tax politics

HM Revenue & Customs is under fire from the Public Accounts Committee …

HMRC ignorance and inaction “rewarding the unscrupulous” and looks “soft on fraud”

In a report published today the Public Accounts Committee says “HMRC’s unambitious plans” for recovering a total of £6 billion it estimates it spent incorrectly in COVID-19 support payments – whether through fraud or mistakes - could lead to “government writing off at least £4 billion” taxpayers’ money. The PAC says this “risks rewarding the unscrupulous and sending a message that HMRC is soft on fraud”.

The Committee says “yet again customer service has collapsed and HMRC’s recovery plans are not clear”, and it is extremely concerned about HMRC’s capacity to clear backlogs while tackling the “avalanche of error and fraud it now faces on the COVID-19 schemes”.

The report describes a litany of longstanding PAC concerns in HMRC’s fulfilment of its most basic remit of collecting tax owed including not responding adequately to tax avoidance schemes, failing on implementing or realising benefits from the ‘Making Tax Digital’ and other long-term transformation ambitions and programmes, and being without “a convincing plan for restoring compliance activity back to pre-pandemic levels”.

The Committee also says HMRC simply doesn’t know why the cost of key tax reliefs has increased, or how much of that is due to abuse.

I have a particular interest in this issue because of the work that I do on tax gaps and tax spillovers.

ASIO warns Australians are being targeted by foreign spies on dating apps like Tinder and Bumble

Chinese spies attempted to install Labor candidates in federal election

- by Anthony Galloway

Peter Dutton stands firm on China comments after backlash over ‘reckless’ claims

The defence minister has doubled down on his claim that the Chinese Communist Party is backing Anthony Albanese's tilt to become the next prime minister.

- 1980

- 2000

- 2020

- 1980

- 2000

- 2020

Countering China’s Influence Operations: Lessons from Australia

This commentary is part of a new CSIS project exploring the impact of Russian and Chinese information operations in democratic states. Part I of the project examines Russian disinformation campaigns in the United Kingdom and Germany and Chinese disinformation campaigns in Australia and Japan. Read the piece on Germany here, on the United Kingdom ehere, and on Japan here.

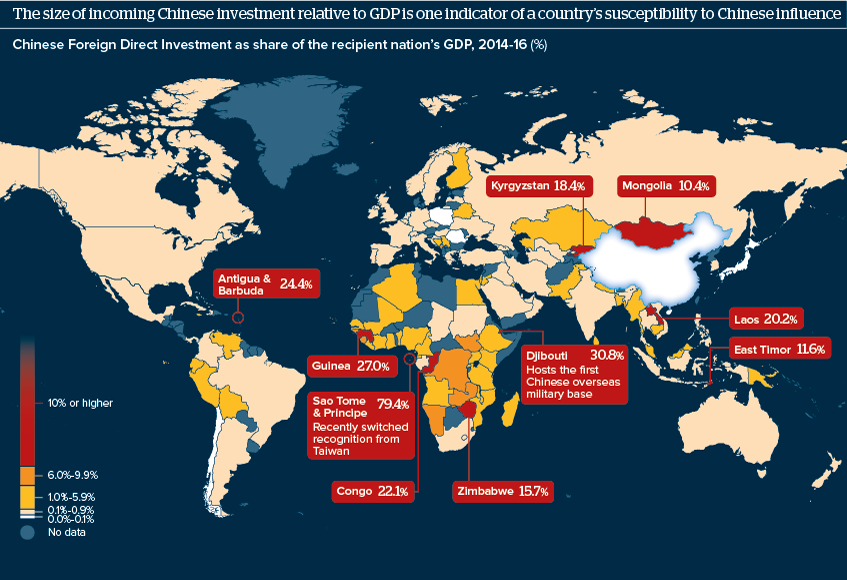

Source: China Global Investment Tracker, World Bank

Two other notable features made Australia particularly vulnerable among advanced democracies, at least in the eyes of Beijing. First, Australia was one of the few advanced democracies in the world that did not prohibit campaign donations from foreigners, creating a wide-open loophole for wealthy Chinese political benefactors with links to the CCP to inject large amounts of money into political campaigns.

Second, Australia has a large community of ethnic Chinese Australian citizens, who are natural targets for United Front activity. Nearly 5 percent of Australians have Chinese ancestry, and the voting weight of this group is augmented by the fact that a proportionally higher number live in several key battleground electoral districts in Melbourne and Sydney, where Chinese Australians represent up to 15 percent of the voting base. It is in these Chinese Australian communities where the CCP and UFWD have worked for decades to cultivate close ties with Beijing. They have done so by coopting Chinese community organizations and providing supportive networks for people sympathetic to Beijing to rise in local prominence while also filtering out negative media coverage in Chinese-language press and drowning out critics.