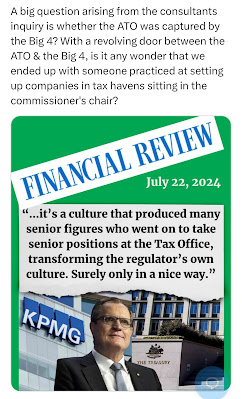

In 2021 nine politicians including Albanese were told of Chris Jordan's previous direct involvement with a company in a secrecy jurisdiction. But none asked governance questions about what the former Tax Commissioner was doing with an Isle of Man company.

Chris Jordan’s valuable insights into shell companies

Neil Chenoweth Senior writer

Jul 23, 2024

Labor’s

plan for a beneficial owners register seems to have suffered the same fate as Malcolm Turnbull’s

stab at it in 2017: a consultation process after the election, then little more

is heard.

It

didn’t help that former tax commissioner Chris

Jordan wasn’t a supporter of the register. Greens senator Peter Whish-Wilson

knows this because he asked him about it.

Former tax commissioner Chris

Jordan didn’t see any point to a register to identify the people behind shell

companies. Alex

Ellinghausen

In

2016, Jordan was the hero of the hour, leading the international collaboration

to follow up the Panama Papers (documents leaked from law firm Mossack

Fonseca). They “demand purposeful and swift action,” he promised. “I will not

simply stand by and admire this problem.”

Turnbull

made a beneficial owners register an election promise, amid general fervour for

reform. One of the only contra notes came from curmudgeonly John Passant, a former

assistant commissioner of tax and University of Canberra law lecturer.

Passant,

who died in 2020, grumbled in a letter to The

Sydney Morning Herald in April 2016: “It seems appropriate for the

Commissioner of Taxation, Chris Jordan, to allay any concerns we taxpayers

might have about his previous position as a partner in tax and accounting firm

KPMG. For instance, under his watch, did any arrangements involve tax havens?”

In

fact, Jordan could offer a unique perspective on this. So, when Whish-Wilson

asked him about the register a year later at Senate Estimates in May 2017,

Jordan could have answered many ways.

One

way would have been to say: “Well, it’s funny you should ask, because back in

the day I helped a mate set up a shell company in the Isle of Man and I received

close to $1 million in payments from it, and that just goes to show there are

many completely legitimate ways to use secrecy jurisdictions, so let’s be

careful about a register.”

That

would be transparent. What Jordan actually said was: “A register of beneficial

ownership is just, you know, what someone says someone else owns so … it could

be good, but it could be just a lot of stuff that doesn’t really help us.

“Because

if … people want to do the wrong thing, they’ll be putting all sorts of different

names in places, so I’m not sure it’s a panacea as such.”

Jordan

wasn’t a supporter. Nothing wrong with that! But it underlines the ongoing

awkwardness he created by failing to disclose his previous history when he

became commissioner in 2013, and in annual disclosures since then until he

stepped down in February.

Last

month, The Australian

Financial Review revealed how Jordan, with fellow KPMG partner

Wayne Jones, helped a

friend set up Dinnans Limited in the Isle

of Man in 1998 before it received $3.38 million from an unknown party.

There

were also claims Jones made in a 2018 court case, that Jordan had made up to

$415,000 in undocumented loans, ostensibly to fund Jones’ casino junkets

business. Jones said he repaid the debt via a property transfer to Jordan’s

wife days before Jones’ bankruptcy proceedings.

These

deals were not necessarily improper, but they’re very unusual for a future tax

commissioner. It was important for the government to know about them, and

governance experts said Jordan should have disclosed them.

Then

again, how was it that in his 11 years as commissioner, no one asked about

these matters? It’s believed an ATO audit of Jones discovered the Dinnans

payments in 2017, but nothing came of it.

In

June 2021, an anonymous letter spelled out in detail Jordan’s link to Dinnans,

and went on to make unproven allegations about it.

The

letter was sent to nine current and former politicians, including

then-opposition leader Anthony

Albanese, Senator Penny

Wong, then attorney-general Michaelia Cash, Greens leader Adam Bandt, and

senators Jacqui Lambie

and Pauline Hanson;

five senior regulators and public servants; and eight journalists and media

organisations.

Given

the critical position Jordan held, it seems a simple governance interest that

the government should have checked out, even if just to dismiss any doubt.

But

nothing came of it. The issue was swallowed up in silence – much like the

beneficial owners register.

The

country’s most expert opinion and analysis. Sign up to

our weekly Opinion newsletter.

Neil Chenoweth is an investigative

reporter for The Australian Financial Review. He is based in Sydney and has won

multiple Walkley Awards. Connect with Neil on

Twitter. Email Neil at nchenoweth@afr.com.au