No one can stand against an idea whose time has come!

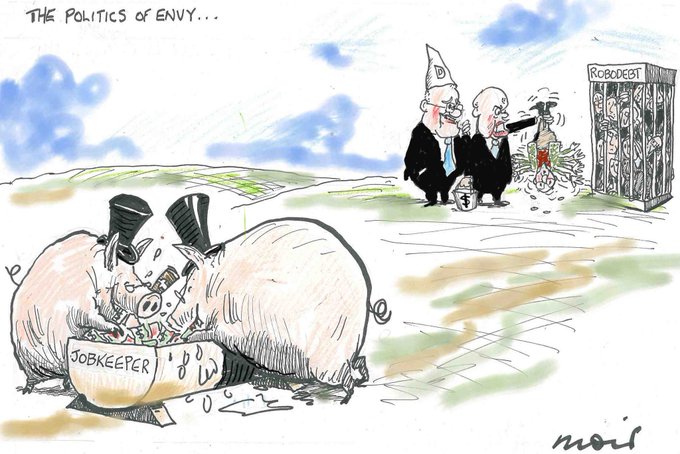

How real is this cartoon about politics of envy courtesy of 255 George Street …

Robodebt victims had 'ice cube's chance in hell' with Centrelink

The robodebt royal commissioner has told a bureaucrat there would have been “an ice cube’s chance in hell” of the debts of some people being erased, and the response to questions over the scheme’s legality was to “hunker down and wait to be sued”.

Compliance officer reveals how robodebt’s toxic, boiler-room culture broke clients and staff

A compliance officer spilled the beans on robodebt's brazen bullying, revealing how staff were stretchered as clients went over the edge.

A serving compliance officer with Services Australia has broken down giving evidence to the Royal Commission into the Robodebt Scheme, describing how a colleague who dealt with a client who took their own life because of the illegal shakedown just shut down, and then never returned to work.

In a day dominated by senior lawyers providing hollow and technical explanations in evidence for why they didn’t act on, or refer up, advice identifying robodebt as unlawful, the very human cost meted out on coal-face customer service staff who were forced to dump phone calls from desperate clients to a machine exemplified the institutionalised disconnection between client and agency.

Jeannie-Marie Blake, a Services Australia compliance and debt operations officer for 23 years, described how the rollout of robodebt progressively removed human agency from customer interactions and transactions, despite many customers being in vulnerable, difficult positions.

“I did really enjoy working for the public service. We can’t all be lawyers,” Blake quipped.

“But we can all serve the public, and I actually find it quite rewarding to be able to serve people that are, in general terms in Services Australia...often had risky points in their life, were at bad points in their life. I feel pride being able to help them through those times.”

The quick and the dead

Blake described how, under robodebt, a team staffed by many individuals each with decades of hands-on working knowledge of compliance processes and the application of legislation were simply sidelined and had their agency removed to make way for the defective and unlawful practice of averaging annual incomes from a single payslip or payment.

“There was no way a student would have average income over a full financial year when they were finishing degrees or education or would have exams,” Blake said.

Asked whether the problems of averaging were “obvious”, Blake responded “Absolutely. You knew it was going to be inaccurate.”

Blake then described how her Mornington office, once regarded as a knowledge centre, was turned into a robodebt boiler room overnight, hitting the most vulnerable and information-poor clients.

Booster rooster

A big, highly visible display called a ‘boost board’ was hung from the wall so that the number of calls being processed, waiting times and other statistics ostensibly pertaining to performance measurement were displayed for all to see.

Blake put it this way:

“It was all about getting it done. It was no longer about getting it correct. The pillars of correctness, the just getting it right, was gone.

“It was: get it done -- this is how we're doing it.

“I was put into a meeting…and they said, you've got three choices: are you going to transfer to another division where you're happy to do the work? You're going to quit and get a job where you're happy to work? Or you're going to stop complaining and you're going to do the work.”

“Customers that are in receipt of welfare are often very transient by nature,” Blake said.

At the meeting outlining how robodebt was going to be applied, Blake said staff immediately raised concerns surrounding its application and lack of accuracy.

Speaking to those concerns, Blake told the royal commission they were “absolutely obvious to me, and I think to everyone in my team”.

Crash test pilots

When Blake’s office was tasked with the robodebt pilot, it became clear that facts were quickly making way for machine-generated numbers, with outbound contacts to employers to check records dumped.

“It was completely foreign to what we'd normally done. We'd normally look to try and get the information from employers. And this had removed that layer all, where that was our first process.”

Blake said Mornington had successfully resisted the public naming and shaming of staff on the maligned ‘boost board’, but that was only because Mornington was a strong union [Community and Public Sector Union] site.

This prevented the literal naming and shaming of staff on the boost board by keeping employee names off it.

Cracking the code

Throughout the royal commission, secretaries and the senior executive service of the Australian Public Service (APS) have been grilled about their adherence to the APS Code of Conduct in relation to robodebt.

Blake did not mince words, saying the code required public servants to act with honesty and integrity.

“This policy was not honest. Nor did it have any integrity,” Blake said, adding the code talked about “treating people with respect and courtesy.”

Nor were clients treated with respect or courtesy, Blake said.

“I feel that the managers in that instance were in breach of their code of conduct in the way they treated their staff and the way they forced the staff to treat our customers, our public, the public that we are employed to serve,” Blake said.

That evidence has opened a whole new can of worms, Dune size worms at that. For starters, there is now a realistic prospect of a class action by employees for injury in the workplace.

Fade to black

[The following is difficult reading and contains painful and distressing evidence.]

The most damning evidence that Blake gave concerned the withdrawal and implosion of employees who were experiencing the consequences of the policies they were required to mete out.

“There is a particular Friday afternoon and we had a colleague who had a really rough call. Luckily, they were able to get ahold of a social worker. And the social worker stayed on the call with them until they got a welfare check. And at which point the staff member was instructed that they could end the call now,” Blake said, visibly upset.

“When they came into work on Monday, they were told that that person suicided over the weekend. And if you're upset about that, call EAP [employment assistance program] and they'll get a social worker out to the team.”

“The employee assistance program that fixes everything,” Blake bristled.

“We got a social worker come in -- I don't know six/eight weeks later -- and did a whole thing with the team. And they said, ‘Well, we understand somebody in the room had had an incident. Does anyone want to talk about it?’

“And that colleague had to relive that experience that had happened. Retraumatized themselves while they were explaining what happened.

“Then we discussed it in the room, and everyone was upset. I don't think there was a dry eye in that room. And then at the end, we went with that person out to have a cigarette.

“And then we saw the social workers just drive off. Seeya later, job done. Not even a check-in to that colleague [to] say, are you okay?

“That colleague worked for 30 years. And I saw that colleague, after that, just give up.

“They used all their personal leave.

“There was no ‘thanks for your 30 years of service’. It was just oh, by the way, that colleague is no longer coming back once they had exhausted all their personal leave,” Blake said.

This article references suicide and mental health issues. If you or a loved one need help, contact Lifeline at 13 11 14 or lifeline.org.au. In an emergency, call 000.

Victim details time as ‘test case’ to robodebt royal commission

Five years after she’d received Centrelink payments, a woman had her entire tax return taken, but won it back, helping to bring down robodebt