Denmark charges two UK nationals over $1.6bn tax fraud

Denmark charges two UK nationals over $1.6bn tax fraud Move is part of sprawling European investigation into share trading dividend scam Denmark claims it suffered losses of about DKr12.7bn in total from the alleged fraud © Chris Ratcliffe/Bloomberg Share on Twitter (opens new window) Share on Facebook (opens new window) Share on LinkedIn (opens new window) Richard Milne, Nordic and Baltic Correspondent yesterday Print this page Denmark has charged two UK nationals with fraudulently reclaiming $1.6bn in dividend tax as part of a sprawling European investigation.

Sanjay Shah, who now lives in Dubai, has been charged by Danish prosecutors over his alleged involvement in one of the country’s biggest ever frauds for unlawfully claiming DKr9.6bn ($1.6bn) in tax refunds from Denmark’s tax authorities together with another British national.

“This is a case of extremely serious and extraordinarily extensive crime committed against the Danish state, and we believe that the two defendants committed cynical and meticulously planned fraud in a scheme where they defrauded the Danish state of DKr9bn,” said Per Fiig, acting state prosecutor for serious economic and international crime. Denmark, Germany, Italy and France are among the European countries hardest hit by the “cum-ex” scandal, in which governments were duped into refunding billions of euros of dividend taxes that had never been paid.

The schemes involved trading shares repeatedly around dividend payment days to give the appearance of multiple owners, each of whom could claim a tax refund. Danish prosecutors declined to give the names of the two people charged other than to say one was resident in Dubai but Mr Shah’s spokesperson confirmed to the Financial Times that he had been indicted.

“I have spoken to Mr Shah and he and his lawyers have no more information than the media has. Mr Shah continues to deny any wrongdoing and stresses that he took professional advice before carrying out the trades,” the spokesperson added. A £15m property belonging to Mr Shah in central London was seized by Danish prosecutors last year.

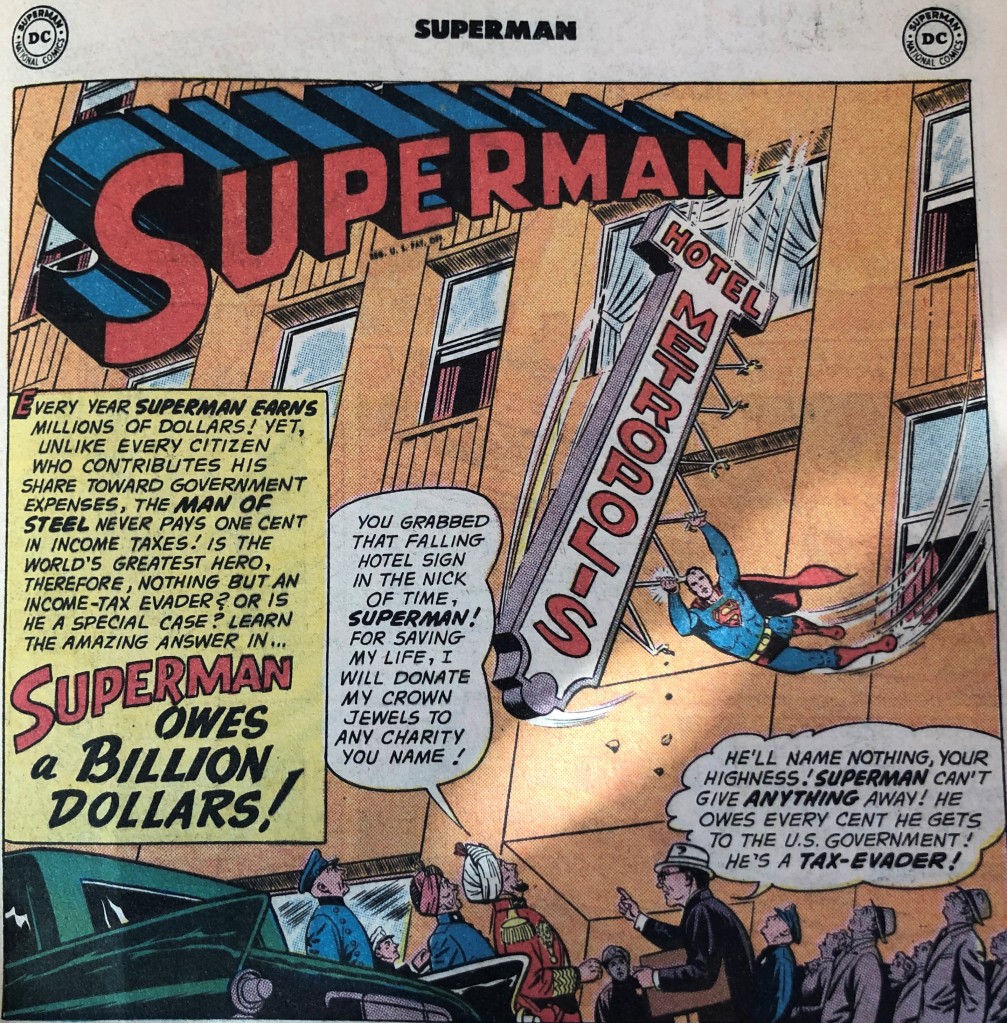

Superman, Tax Evader?

The basic premise is that a new Revenue Agent “at the Internal Revenue Bureau in Metropolis,” Rupert Brand,* discovers “no record that Superman has ever paid taxes!” (In case you’re wondering, nope, the IRS was not called the “Internal Revenue Bureau” back then. In 1953, it changed its name from the “Bureau of Internal Revenue” to the “Internal Revenue Service.” Perhaps a clue that not to rely on any of the tax statements in the story!)

Johnson says UK can use tax to drive investment outside EU (4 Jan 2021)

British ruling class described as ‘mendacious, intellectually limited hustlers’ in New York Times (4 Jan 2021)

Richest 1% have almost a quarter of UK wealth, study claims (3 Jan 2021)

Thumbs-up for a wealth tax to help the poor — just don’t touch the family home (3 Jan 2021)

Does the Brexit deal pave the way for Britain to become a tax haven? (1 JAN 2021)

New York prosecutor hires forensic accountants as criminal investigation into Trump Organization escalates (30 Dec 2020)

Facebook to close Irish holding companies at centre of tax dispute

Corporate Transparency Act – Beneficial Ownership of Shell Corporations Must Be Disclosed

Whistleblower FYE 2020 Report

L.A. Times: California Assesses Retroactive Tax Against Small Businesses Rather Than Amazon

My 2021 Forecasts / Year in Preview The Big Picture

Paygone Ryan Grim, Bad News

The Supply Chain Gang The Baffler. From November, still germane.

25 Days That Changed the World: How Covid-19 Slipped China’s Grasp NYT. A second retrospective.

A Q&A about the new coronavirus variant with the Fred Hutch scientist who’s been tracking its spread Seattle Times

Creating a culture of change

Legacy infrastructure and outmoded ways of thinking can trip up digital transformation projects in the public sector