The main difference between men and women is that men are lunatics and women are idiots.

— Rebecca West, who died in 1983Beware This Incredibly Lunatic and Silly—But Still Effective—Tax Scam

Slovakian journalist investigating claims of tax fraud linked to ruling Party ...

Kuciak was working for the Aktuality.sk news website, where he focused mainly on tax evasion stories. His last piece was published on 9 February and covered a suspected tax fraud connected to a luxury apartment complex in Bratislava known as the Five Star Residence. The report identified suspicious transactions among five companies.

IT Dept probes Rs 10-bn tax refund fraud by govt and PSU employees

Tax Fraud Blotter: 'Til parole do they part

Australian businessman Rohan Arnold extradited from Serbia over $500m cocaine importation

Three arrested in £1m tax fraud probe

HMRC worker Nicola Shaw sentenced for £50000 tax fraud

HMRC adviser Amjad Khan jailed for £40000 tax fraud

BBC News

An Inland Revenue adviser who did not pay income tax for 13 years has been jailed, with a judge saying sparing him from custody would cause "outrage". Amjad Khan, 38, failed to pay almost £16,000 between 2002 and 2015 while working for the HMRC in Bradford.

He also pocketed nearly £24,000 in tax credits to which he was not entitled as part of the "appalling and blatant" fraud.

Khan admitted the fraud offences at Bradford Crown Court last year.

At the same time as he was working for the HMRC in Bradford city centre, the married father-of-three was also earning money through a property rental business and his work as a self-employed gas and heating engineer.

At the same time as he was working for the HMRC in Bradford city centre, the married father-of-three was also earning money through a property rental business and his work as a self-employed gas and heating engineer.

'Public would be outraged'

Prosecutor Howard Shaw said Khan of Burnett Avenue, Bradford, had claimed in a tax return for the year 2014/15 that both his businesses were loss-making even though analysis of his bank accounts showed they were profitable. Defence barrister Emma Downing said a constructive alternative to immediate custody could include unpaid work for the community. However, the Recorder of Bradford, Judge Jonathan Durham Hall QC, said all the time Khan had been working for HMRC advising people about their "rights and wrongs" he had been committing fraud against the state.

"You were evading income tax over a 13-year period," said the judge, who described the frauds as "appalling and blatant". The judge said a 20-month prison sentence would have to be served and the public would be outraged if the court did not deal with Khan in a robust way. Khan is expected face a further hearing under the Proceeds of Crime Act later in the year in bid to get back the money he obtained through fraud.

Nayanaka Arjuna Samarakoon pleaded guilty to criminal offences that included dealing with property reasonably suspected of being proceeds of crime and attempting to obtain a financial advantage by deception.

Convicted SMSF auditor disqualified

The Commonwealth Director of Public Prosecutions (CDPP) revealed that Victorian-based tax agent Brendan Harty had been sentenced to jail for seven years – with a non-parole period of four years and nine months – after he pleaded guilty to multiple counts of dishonestly obtaining funds.

Tax agent jailed for client thefts, fraudDespite first automated car fatality in US

Uber suspends self-driving car tests after vehicle hits and kills woman crossing the street in Arizona

An Uber self-driving car hits and kills a woman crossing the street in Arizona, marking the first time a self-driving car has killed a pedestrian and dealing a potential blow to technology which is expected to ...

ABC Online

OUR TECH LORDS CERTAINLY LOVE THEIR SERFS: Mark Zuckerberg once called Facebook users ‘dumb f***s’ for handing personal data over to him – as firm becomes further embroiled in Cambridge Analytica row

UK Tax Office boss Jon Thompson on acclimatising to the civil service, learning to be a permanent secretary and why he took on the job.

"I went to a comprehensive school, left at 18 and became an apprentice; then 30 years later I was offered the job of permanent secretary of the Ministry of Defence. There is a long journey in those 30 years.” (Civil Service World)

Gavin Slater’s digital dispatch: don’t just collaborate for the sake of it.

The taxpayer is best served by agencies working together, but define your goal before you decide whether to collaborate, counsels the DTA boss.

Policy Shop podcast: does Australia have a gambling problem?

"Based on per capita spending, Australians are the world’s most prolific gamblers." (Melbourne University)

NextGov – The IRS System Processing Your Taxes is Almost 60 Years Old: “One of the IRS’ most important tax-processing applications is old enough to be a grandparent, and officials warn a failure during tax season could have dire economic ramifications or delay tax refunds for 100 million Americans. The Individual Master File, a massive application written in the antiquated and low-level Assembly programming language, is comprised of data from 1 billion taxpayer accounts going back decades, and chiefly responsible for receiving individual taxpayer data and dispensing refunds. Despite hundreds of millions in spending, plans to fully modernize the application are more than six years behind schedule, and in a statement to Nextgov, IRS revised its new timeline for a modernized IMF to 2022.“To address the risk of a system failure, the IRS has a plan to modernize two core components of the IMF by 2021, followed by a year of parallel validation before retiring those components in 2022,” the IRS said. The timeline could slip further, however, because IRS will need the authority to hire at least 50 additional employees—and backfill any losses—and receive an additional $85 million in annual non-labor funding for the next five years. The president’s fiscal 2018 budget request would cut IRS funding by $239 million…”

WELL, THIS IS LATITUDE EAST AND THE 21ST CENTURY, YOU KNOW: This 25-Year-Old Lived For More Than a Year Without a Heart.

Crackdown on black economy could yield $6bn: KPMG

“At a time when other revenue measures are struggling for bipartisan support, the proposed crackdown on the black economy

is more likely to gain passage through the Senate, generating

much-needed additional revenue for budget repair,” said *Grant

Wardell-Johnson, a KPMG partner at the Economics ...

Govt flags Facebook inquiries over data disclosure concerns

The proof Big Un CEO Richard Evertz did prison time for blackmail

Qld premier bans ministers from private email accounts

Jonathan Haidt, The Righteous Mind: Why Good People Are Divided by Politics and Religion

A series of world maps uses the literal translations of countries’ names

↩︎ KottkeTwo days after St Jozef's Day, on March 21, the Department of Interior will hold the largest auction of offshore leases in US history.

↩︎ Outside Magazine

Fermi famously asked:

'Where is everybody?' Probably dead, says renewed Drake equation

Kimberly Houser (Washington State), The Use of Big Data Analytics by the IRS: What Tax Practitioners Need to Know

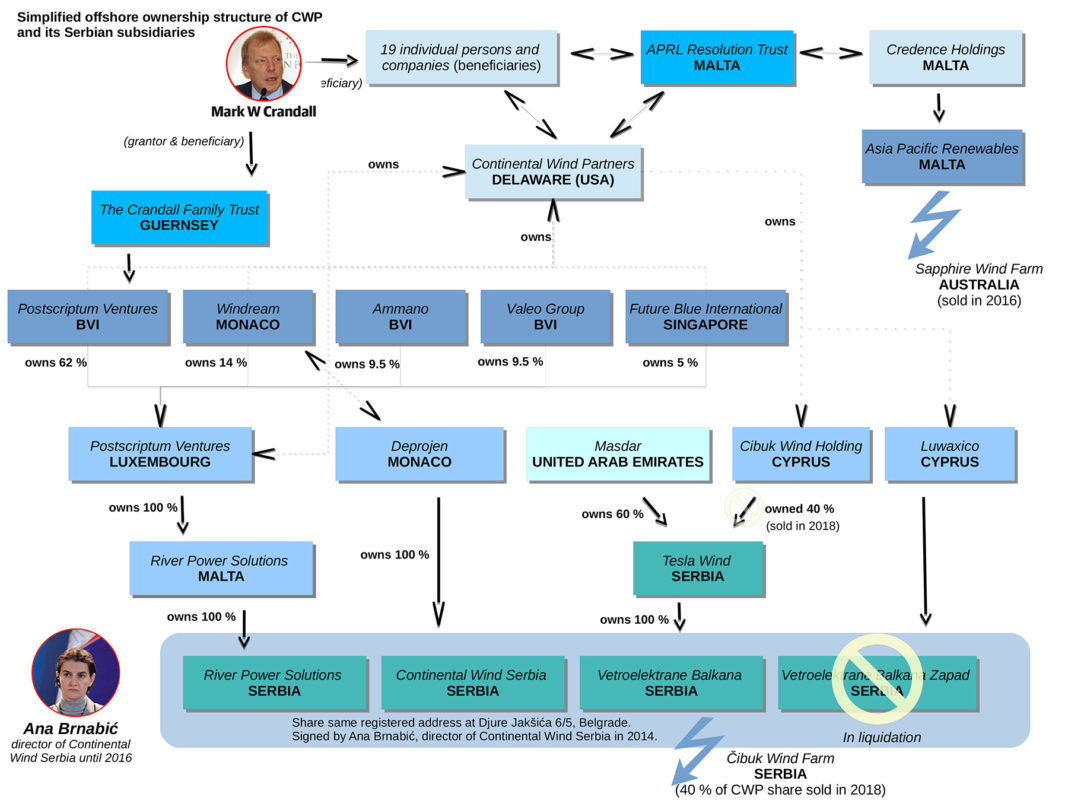

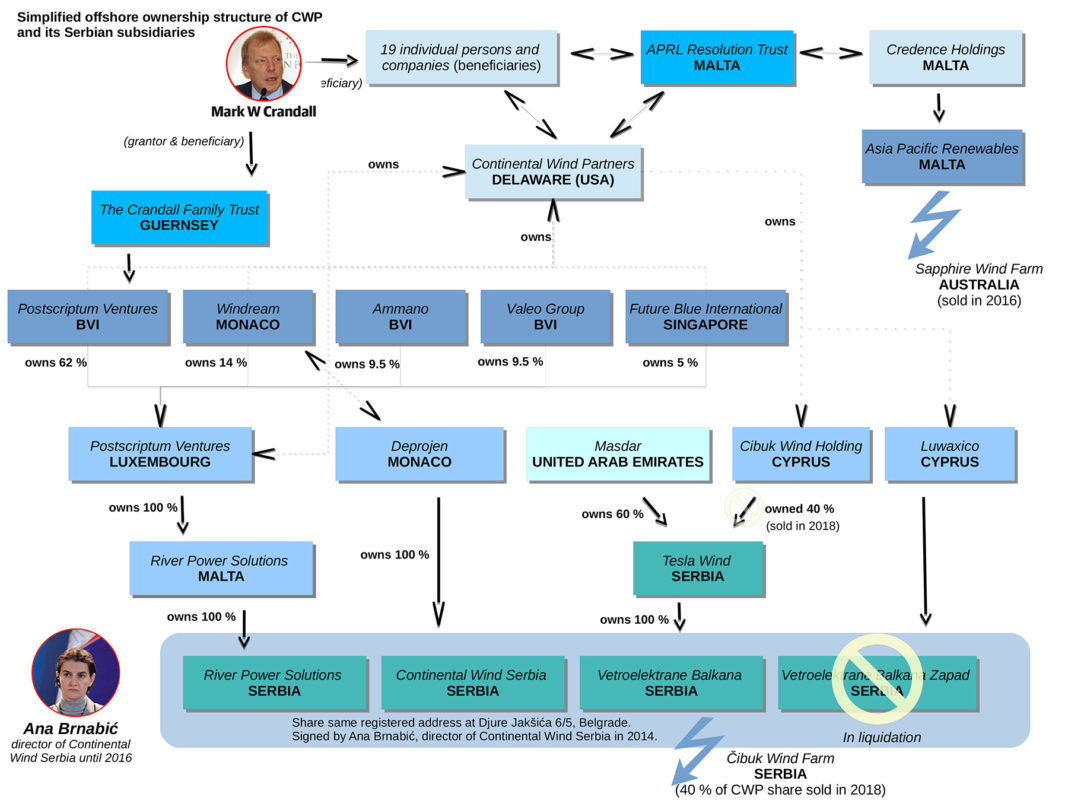

Dealing of Former Serbian PM

Kathleen Delaney Thomas (North Carolina) presents Taxing the Gig Economy, 166 U. Pa. L. Rev. ___ (2017), at UC-Irvine today as part of its Tax Law and Policy Colloquium Series hosted by Omri Marian:

Due

to advances in technology like mobile applications and online

platforms, millions of American workers now earn income through “gig”

work, which allows them the flexibility to set their own hours and

choose which jobs to take. To the surprise of many gig workers, the tax

law considers them to be “business owners,” which subjects them to

onerous recordkeeping and filing requirements, along with the obligation

to pay quarterly estimated taxes.

Kathleen Delaney Thomas (North Carolina) presents Taxing the Gig Economy, 166 U. Pa. L. Rev. ___ (2017), at UC-Irvine today as part of its Tax Law and Policy Colloquium Series hosted by Omri Marian:

Due

to advances in technology like mobile applications and online

platforms, millions of American workers now earn income through “gig”

work, which allows them the flexibility to set their own hours and

choose which jobs to take. To the surprise of many gig workers, the tax

law considers them to be “business owners,” which subjects them to

onerous recordkeeping and filing requirements, along with the obligation

to pay quarterly estimated taxes.

↩︎ Outside Magazine

ANALYSIS: TRUE. No one can pretend Facebook is just harmless fun any more

Even if we want to avoid the site and keep our data protected, it’s not as easy as one might think.. .

ANTISOCIAL MEDIA: Facebook may have broken FTC deal in Cambridge Analytica incident

For people living on the economic margins, even minor offenses can impose crushing financial obligations, trapping them in a cycle of debt and incarceration for nonpayment. In Ferguson, Mo., for example, a single $151 parking violation sent a black woman struggling with homelessness into a seven-year odyssey of court appearances, arrest warrants and jail time connected to her inability to pay.

Across America, one-size-fits-all fines are the norm, which I demonstrate in an article for the University of Chicago Law Review. Where judges do have wiggle room to choose the size of a fine, mandatory minimums and maximums often tie their hands. Some states even prohibit consideration of a person’s income. And when courts are allowed to take finances into account, they frequently fail to do so.

Dealing of Former Serbian PM

New York Times p. 1: Tax Law’s Errors Upset Employers As Leaders Feud, by Jim Tankersley & Alan Rappeport:

The

legislative blitz that rocketed the $1.5 trillion tax cut through

Congress in less than two months created a host of errors and

ambiguities in the law that businesses big and small are just now

discovering and scrambling to address.

Companies

and trade groups are pushing the Treasury Department and Congress to

fix the law’s consequences, some intended and some not, including

provisions that disadvantage certain farmers, hurt restaurateurs and

retailers and could balloon the tax bills of large multinational

corporations.

While

Treasury can clear up uncertainty about some of the murky provisions,

actual errors and unintended language can be solved only legislatively —

at a time when Democrats seem disinclined to lend votes to shoring up a

law they had no hand in passing and are actively trying to dismantle.