~ Chris Jordan FCA Commissioner of the Australian Tax Office

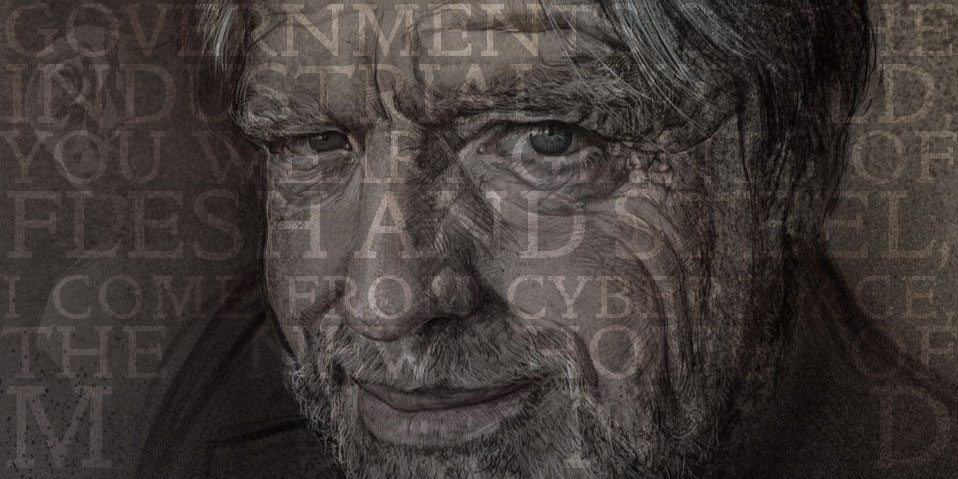

John Perry Barlow, the prolific Grateful Dead lyricist who collaborated with Bob Weir from 1971-1995, visionary internet pioneer, political activist, co-founder of the Electronic Frontier Foundation and author of many thoughtful essays including the widely read “A Declaration of the Independence of Cyberspace“, sadly passed away in his sleep on February 6, 2018 at the age of 70. Friends, family and fans have taken to social media to express their sadness at the loss of such an incredible man.

Remembering John Perry Barlow, co-founder of Freedom of the Press

Media Dragons using computers in the 80s/90s (Corey Haim, Shakira, Brad Pitt, Christian Bale) and me using a computer in 1996

“The Commission's presentation even suggests that the UK

could be added to the EU's blacklist of 'uncooperative' tax jurisdictions…”

RSM (slides presented to the Council Working

Party, PDF)

Omri Marian (UC-Irvine), What We Now Know We Didn't Know About Tax Evasion (And Why It Matters) (JOTWELL) (reviewing Annette Alstadsæter, Niels Johannesen & Gabriel Zucman, Tax Evasion and Inequality (NBER Working Paper No. 23772 (2017)):

Omri Marian (UC-Irvine), What We Now Know We Didn't Know About Tax Evasion (And Why It Matters) (JOTWELL) (reviewing Annette Alstadsæter, Niels Johannesen & Gabriel Zucman, Tax Evasion and Inequality (NBER Working Paper No. 23772 (2017)):

Media Dragon: Chris Jordan: Tax crackdown targets wealthy cheats

Former treasurer Wayne Swan to bow out of federal politics

Clamping Down on Tax Evasion

Over the past several years, a series of leaks related to offshore tax avoidance and evasion (SwissLeaks, LuxLeaks, the Panama Papers, Bahama Leaks, and Paradise Papers, to name a few) has fueled calls for tax transparency. To date, most discussion of the leaks has been policy-oriented (leaks: good or bad?) and largely anecdotal (based on some truly outrageous revelations). It was not until very recently, however, that a small group of researches started delving into the data exposed by these leaks to make statistically significant empirical findings. Alstadsæter, Johannesen & Zucman’s (AJZ) paper is an excellent example of such paper, which combines methodological sophistication, public data, and leaked data, to make important new contributions to the voluminous literature on the offshore tax world. ...

Five years down the track, the ATO is getting on better with taxpayers –

but it’s still exchanging friendly fire with tax agents.

- Chris

Jordan is widely regarded as having had a successful first five years as

Australia’s Tax Commissioner.

- The ATO

is turning its focus from multinationals to individuals and small

businesses.

- Jordan

intends to keep pursuing tax system automation.

Anyone who accepts the job of tax commissioner will face doubters. When

Chris Jordan FCA took the role in 2012, he recalls with a grin: “I had a lot of

friends and colleagues quite helpfully saying: ‘Are you mad? What do you think

you’re doing?’”

Media Dragon: Tax Chief: Chris Jordan Exclusive Inteviews

- Tax avoidance firm Future Capital Partners faces closure as HMRC probes investors (8 Feb 2018)

- The chairman of Samsung has been named

as a suspect in a $7.5 million tax evasion case (8 Feb 2018)

- Alexis Sánchez accepts prison sentence for tax fraud but will avoid jail (8 Feb 2018)

- Big Tech should pay more taxes: German coalition (8 Feb 2018)

- Rabobank NA Pleads Guilty, Agrees to Pay Over $360 Million (8 Feb 2018)

- As a Result of Rabobank’s Bank Secrecy Act and Anti-Money Laundering Failures it Processed over $360 Million in Illicit Funds and then Conspired with its Executives in an Attempt to Conceal These Ongoing Failures From its Regulator (8 Feb 2018)

- Timetable proposed for register of foreign entities owning UK property (8 Feb 2018)

- The

UK Government has confirmed it is opposed to public access to its

register of beneficial owners of trusts (8 Feb 2018)

- India chases 100000 for tax on cryptocurrency profits (8 Feb 2018)

- Canada:

NDP to challenge Liberals to cut tax havens, stock option

loopholes (8 Feb 2018)

- Australia joins global push to cut corporate tax rates (8 Feb 2018)

- HMRC

announces Glasgow hub location (8 Feb 2018)

- UK

Tax and mortgage crackdown cuts buy-to-let investment by 80pc

(8 Feb 2018)

- BBC: new evidence of mass abuse of UK shell firms by corrupt Ukrainians (7 Feb 2018)

- Scots shell firms play key role in Latin America's bribery 'mega scandal (7 Feb 2018)

- Corrupt Scots shell firms "anti-social enterprises" (7 Feb 2018)

- UK Money laundering bill offers chance to tackle tax loopholes (7 Feb 2018)

- Rabobank

to enter plea in money-laundering investigation

(7 Feb 2018)

- Commonwealth Bank profit falls amid money-laundering scandal (7 Feb 2018)

- BIS Chief Sees 'Strong Case' for Cryptocurrency Intervention (7 Feb 2018)

- Pakistan to Profile Citizens to Combat Rampant Tax Avoidance (7 Feb 2018)

- HMRC

guidance on changes to enveloped UK dwellings (7 Feb 2018)

- HMRC

Guidance: Enveloped UK dwellings and related finance (7 Feb

2018)

- Amazon settles tax row with France, value undisclosed (6 Feb 2018)

- Amazon settles €200 million French tax dispute (6 Feb 2018)

- McDonnell's

anger over Tories' £2.1bn failure from tax avoidance clampdown

(6 Feb 2018)

- A special tax to save the struggling NHS won't work. Here's why (6 Feb 2018)

- Are Trump's tax cuts backfiring on Wall Street? (6 Feb 2018)

- US tax reform to bring double taxation to some Canadians (6 Feb 2018)

- Potters Bar, Ukraine's

stolen billions and the Eurovision connection (6 Feb

2018)

- Novartis bribery probe: ten Greek ex-ministers allegedly involved (6 Feb 2018)

- The 9 places in the US where Americans don't pay state income taxes (6 Feb 2016)

- 'We

have no problem with Irish tax system' - OECD

(6 Feb 2018)

- CCCTB:

Hungary and Ireland build front to say no to EU tax harmonisation plan

(6 Feb 2018)

- Virgin Money joins ban on buying Bitcoin on credit cards (6 Feb 2018)

Capital-gains sting by tax office for Airbnb hosts

Analysts find 'improbable' mortgage data

Home loan borrowers could be hiding how much they earn but analysts aren't sure whether they are lying to their banks, the ATO, the census or the Australian Bureau of Statistics. ...Quote of the week: