By a sea of strange coincidences Fintan O'Toole might be related to my hero ;-) We should collect Apple's £13 billion and change Ireland: Take Your Pick!

The entire point of life is to be noticed. You want people to notice you. Otherwise, what’s the point? Why even bother. When I’m walking down Fifth Avenue and someone doesn’t peek at me at least a little bit, I give them a little shove. “Hey buddy! Here I am. Deal with it.”

And it isn’t enough just to be noticed. I could walk down the street in a clown suit and people would notice. I don’t want that. I want respect. I want to be respected. Respect. Noticed and respected. The best way — the only way — to get both immediately is to look important. Gary would probably say something completely impractical like “do good work and respect will come.” Who’s got time for that? That’s probably why I’m in Nevis and he’s in his office writing product reviews. (He probably doesn’t even know where Nevis is.) The arrogant tax lawyer guide to looking important

Corruption Currents: U.S. Pays Millions to BHP Billiton Whistleblower WSJ

HMRC too fragmented and failing to address customer service

Billions in Losses Trigger Danish Overhaul of Taxation Model

Confronting tax fraud, Denmark will hire tax inspectors instead of firing them

Jack Townsend, Congressional Staffer Charged with Failure to File. “I post this item because it is unexceptional and exceptional for failure to file cases.”

Leslie Book, Tax Crime Snapshot: Ministers, Congressional Staffers and Restaurant Owners. “Politico reported this week that ‘Isaac Lanier Avant, chief of staff to Rep. Bennie Thompson (D-Miss.) and Democratic staff director for the Homeland Security Committee, allegedly did not file returns for the 2009 to 2013 tax years.'”

Great political figures tend to be inspired not by wealth or comfort but by honor and recognition. Few tempted by ambition are about to resist it... Importance of Being

Europe plans news levy on search engines Financial Times

The US Treasury just declared tax war on Europe Efforts around the world to crack down on tax dodges by businesses and wealthy individuals via overseas tax havens are making progress. A draft criteria compiled by the OECD to beef up international rules on taxation is likely to be formally approved at the Group of 20 summit in Hangzhou, China, early next month, with the number of countries taking part in the framework for such efforts expected to top 100 by the end of the year.

Stop

International Tax HavensThe US Treasury just declared tax war on Europe Efforts around the world to crack down on tax dodges by businesses and wealthy individuals via overseas tax havens are making progress. A draft criteria compiled by the OECD to beef up international rules on taxation is likely to be formally approved at the Group of 20 summit in Hangzhou, China, early next month, with the number of countries taking part in the framework for such efforts expected to top 100 by the end of the year.

These 2 tax havens rank above Switzerland on per capita

Panama Papers Prompt Race for Tax Haven Dollars Before Crackdown

HMRC secured 13 offshore specific prosecutions since 2009

In United States v. Morrison, ___ F.3d ___, 2016 U.S. App. LEXIS 14888 (5th Cir. 2016), here, an appeal from a trial by Judge John H. McBryde (ND TX), the Fifth Circuit affirmed the taxpayers' convictions. The Fifth Circuit's opening gives the background relevant for the present discussion (bold-face supplied by JAT):

Running a profitable small business is notoriously difficult. But the clients of a tax preparation service run by a husband and wife, Gladstone and Jacqueline Morrison, brought business failure to a new level. Year in and year out, the vast majority of the clients submitted tax returns showing sizable business losses. A federal jury provided the following explanation for this seeming anomaly of unlucky clients: the Morrisons helped their clients prepare returns with fake business losses so the clients could obtain refunds rather than pay the taxes they owed Via Jack Townsend Federaltaxcrimes

U.K. Threatens Tax Evaders With Fines Three Times Unpaid Taxes

August Tax Justice Network podcast: are the big four accountancy firms really the ‘big one’?

UBS whistleblower exposes ‘political prostitution’ all the way up to President Obama International Business Times

David Herzig, House Staffer is a Tax Protester? (Surly Subgroup). “I mean, who at payroll in Congress is green-lighting the stopping of withholding?”

National Law Review, Taxpayer Argues First Circuit Should Not Follow Tax Court Decision by Judge Indicted for Tax Fraud. “The taxpayer’s brief argues that the Tax Court opinion in Bank of New York Mellon should not be followed because ‘the judge in that case—Judge Diane Kroupa—faced a disabling conflict when she rendered” the opinion due to the fact that she was indicted for tax fraud in April 2016 and was under audit by the IRS and allegedly committing further tax fraud at the time she was considering the Bank of New York Mellon case.'”

Wall Street Journal, Republicans Take New Tack on Taxing Companies’ Overseas Profits:

President Ronald Reagan once chided government’s approach to the economy as following this mantra: “If it moves, tax it.”

Today’s

Republicans are following Mr. Reagan’s ideas by trying the exact

opposite approach. The tax plans from House Republicans and presidential

candidate Donald Trump stop aiming at the moving target of U.S.

companies’ foreign profits. Their plans would alter existing rules so

thoroughly that companies would get little advantage from cross-border

tax maneuvers they perfected over decades and move the U.S. toward

taxing immobile parts of the economy.

Department of Justice Press Release, Congressional Staffer Charged with Failure to File Tax Returns for Five Years:

A

congressional staffer was charged yesterday with five counts of

willfully failing to file a tax return, announced Principal Deputy

Assistant Attorney General Caroline D. Ciraolo, head of the Justice

Department’s Tax Division and U.S. Attorney Dana J. Boente for the

Eastern District of Virginia.

HMRC: Tough new sanctions for offshore tax evaders

Russ Fox, Paying Employment Taxes Is Optional…Until You Get Caught. “If you want to visit ClubFed, having employees and not remitting payroll taxes is a quick and easy way to do so.”

Jack Townsend, Sentencing for Defendant Implicated in Early UBS Disclosures. “Lying to the IRS or being economical with the truth in submissions to the IRS where full cooperation is required is a no-no.”

Farewell to Jan Farrell

Bloomberg: What Is Amazon’s Core Tech Worth? Depends on Which Taxman Asks, by Gaspard Sebag & David Kocieniewski:

Jeff

Bezos’s relentless focus on user experience has helped him make Amazon

the most valuable e-commerce company in the world. But regulators in

Europe and the U.S. say that the value Amazon places on the technology

behind that experience varies radically depending on which side of the

Atlantic it’s on—and which appraisal will lower its tax bill.

Frank Wolpe (Bentley), Getting Back to the "Grassroots" of Tax Administration: Because "We the People" Long For a Gathering of American Eagles to Restore Trust in the Internal Revenue Service with A Rebuild IRS Initiative, 49 Akron L. Rev. 863 (2016)

Assets of Scottish shell firm seized amid probe in to allegedly corrupt Ukrainian MP Herald Scotland

Hundreds of Scottish PFI schools now owned by offshore funds

Assets of Scottish shell firm seized amid probe in to allegedly corrupt Ukrainian MP Herald Scotland

Hundreds of Scottish PFI schools now owned by offshore funds

Tax Vox: Federal Taxes Are Very Progressive, by Robertson Williams:

The US federal tax system is highly progressive, primarily because individual income tax rates rise sharply with income and refundable tax credits lead to negative income taxes for households with low income. Updated estimates from the Tax Policy Center project that effective federal tax rates this year will range from 3.5 percent for households in the lowest-income quintile (or fifth) to 33.0 percent for those in the top 1 percent.

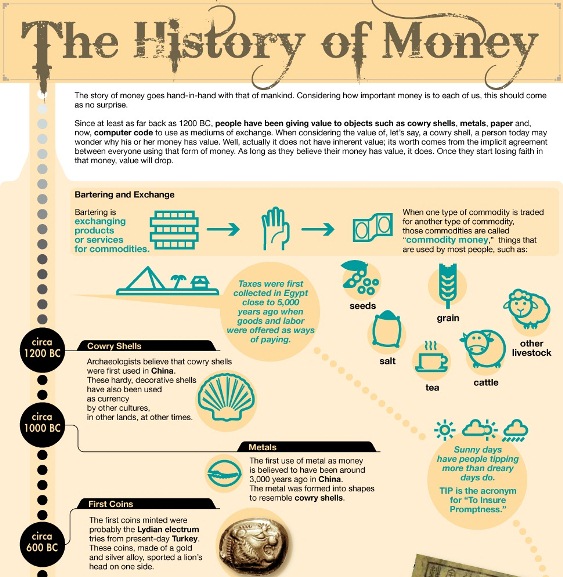

The History of Money: Not What You Think The Minskys

CCH Daily, 19/8/16. HMRC plans to use the introduction of the Making Tax Digital (MTD) online strategy to move to a points-based penalty regime for failure to submit tax information on time, using a graduated model similar to the ‘speeding points’ system used for drivers who break the law, and is also potentially seeking wider investigative powers

Keith Fogg, The First Reconsideration of a Case Due to Former Judge Kroupa’s Tax Problems (Procedurally Taxing):

World losing $2.6trn annually to corruption

The Real Russian Mole Inside NSA.

The recent appearance on the Internet of top secret hacking tools from the National Security Agency has shined yet another unwanted spotlight on that hard-luck agency, which has been reeling for three years from Edward Snowden’s defection to Moscow after stealing more than a million classified documents from NSA. As I explained, this latest debacle was not a “hack”—rather, it’s a clear sign that the agency has a mole.

HMRC takes aim at tax dodgers hiding foreign income

ABA Perspectives: A Magazine For and About Women Lawyers, Vol. 24, No. 4, Summer 2016, at 8:

CCH Daily, 19/8/16. HMRC plans to use the introduction of the Making Tax Digital (MTD) online strategy to move to a points-based penalty regime for failure to submit tax information on time, using a graduated model similar to the ‘speeding points’ system used for drivers who break the law, and is also potentially seeking wider investigative powers

Keith Fogg, The First Reconsideration of a Case Due to Former Judge Kroupa’s Tax Problems (Procedurally Taxing):

Former Tax Court Judge Kroupa resigned from the Tax Court on June 16, 2014, apparently in response to an IRS criminal investigation concerning the tax liabilities of herself and her husband. We previously reported on her resignationhere. At the time the indictment came out, some speculation occurred in the tax press about the impact of her tax troubles on the decisions she rendered, see here. In Eaton Corporation v. Commissioner the first case that we are aware of involving the fallout of Judge Kroupa’s indictment comes before the Tax Court for it to review whether her decision should be reconsidered.

World losing $2.6trn annually to corruption

The Real Russian Mole Inside NSA.

The recent appearance on the Internet of top secret hacking tools from the National Security Agency has shined yet another unwanted spotlight on that hard-luck agency, which has been reeling for three years from Edward Snowden’s defection to Moscow after stealing more than a million classified documents from NSA. As I explained, this latest debacle was not a “hack”—rather, it’s a clear sign that the agency has a mole.

HMRC takes aim at tax dodgers hiding foreign income

ABA Perspectives: A Magazine For and About Women Lawyers, Vol. 24, No. 4, Summer 2016, at 8:

In September, [Lewis & Clark Dean Jennifer] Johnson will host the first Gathering of Women Law School Deans,

a day-long event to facilitate conversations on topics of mutual

interest. The challenges are especially acute now as the world of legal

education undergoes a seismic shift. ...