To add to the thoughtful trivia evening with MO'N, Tyson, Elizabeth, Brett and Tunisia bound Mike, it should be noted that the Irish bookmaker Paddy Power has laid odds on the next world leader to resign over the Panama Papers’ revelations. The current leader is Argentine President Mauricio Macri at 8-1. Queen Elizabeth and Barack Obama at both at 66-1, Canada’s Prime Minister Justin Trudeau is at 80-1, and North Korea’s Kim Jong-un is at 100-1.

Speaking of Nostra Damus predictions ...

The OECD has announced an emergency session of tax officials called by the Australian Tax Commissioner, Chris Jordan, to co-ordinate international responses to the massive release of documents of Panamanian law firm Mossack Fonseca. Panama papers ATO calls emergency OECD meeting over Mossack Fonseca files

Prime Minister Malcolm Turnbull has had little, if anything, to say about revelations that hundreds of Australian companies and individuals have availed themselves of tax minimisation arrangements as described in leaked documents from a Panama law firm. This is a global scandal with more to come.

Fallout from corruption scandals continued to roil Europe on Sunday, as Ukrainian Prime Minister Arseny Yatsenyuk announced that he would resign amid a growing political crisis. His resignation came at a time when the country's president, Petro Poroshenko, is under scrutiny after the Panama Paperssuggested that he used an undisclosed offshore company to avoid taxes. Meanwhile, in Russia, one of the key figures named in the Panama Papers deflected accusations that he had helped enrich President Vladimir Putin's inner circle through offshore deals.

Speaking of Nostra Damus predictions ...

They make all-out effort to end the ATO's damaging and disruptive industrial dispute before a federal election is called. Mr Jordan will be going to ATO sites around the country in an effort to sell a slightly revised enterprise agreement to a still skeptical workforce which rejected the previous offer by a crushing margin of 85 per cent in December Tax Offices Bosses Off on a Three week Campaign Caravan

The OECD has announced an emergency session of tax officials called by the Australian Tax Commissioner, Chris Jordan, to co-ordinate international responses to the massive release of documents of Panamanian law firm Mossack Fonseca. Panama papers ATO calls emergency OECD meeting over Mossack Fonseca files

Prime Minister Malcolm Turnbull has had little, if anything, to say about revelations that hundreds of Australian companies and individuals have availed themselves of tax minimisation arrangements as described in leaked documents from a Panama law firm. This is a global scandal with more to come.

Nor has he been forthcoming on calls for the establishment of a Federal Independent Commission Against Corruption (FICAC) Panama papers strengthen case for a federal ICAC

Panama papers and labor's tax trapIt was only a matter of time before the Panama Papers controversy and the Unaoil bribery scandal overlapped Unaoil scandal and the panama papers connections

Unusually for the WSJ, this interview with Jürgen Mossack, co-head of Mossack Fonseca, isn’t behind the paywall. Someone (Mossack?) wants the word to get out as widely as possible. Says the WSJ:

In his first in-depth interview since reports of the leaked documents were published, Jürgen Mossack said his firm did nothing wrong by selling some 240,000 shell companies registered in low- or no-tax territories around the world. #panamapapers: Questioning the Picture Painted in the WSJ’s Interview With Jürgen Mossack

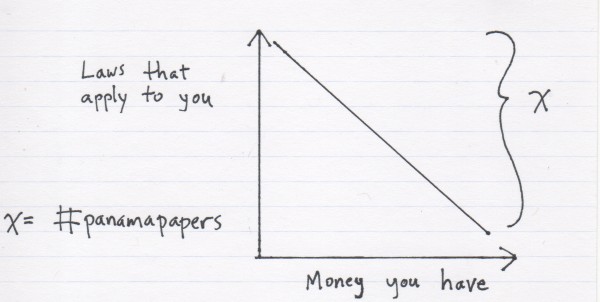

What the Panama Papers Tell Us Global Guerrillas

This week saw the release of the so-called “Panama Papers,” the largest document dump of all time, at least if measured by terabytes ... It’s like the Ashley Madison hack, but but for lawyers and banksters. The implications of the leak might seem dizzyingly complex, but their gist can be distilled into this simple graph- Stats of the week the panama papers explained in one simple graph:

Patricia Cohen, Need to Hide Some Income? You Don’t Have to Go to Panama(NYT 4/7/16), here. Excerpts:

Yet while the United States demands that financial institutions in other countries share information about Americans with accounts abroad, its reciprocation efforts fall short, critics say.

“You see a ton of wealth in tax havens in Switzerland and the Cayman Islands that is owned by shell companies that are incorporated in Panama or in Delaware,” he said. “The bulk of this wealth does not seem to be duly declared on tax returns.”

A recent report by the Institute on Taxation and Economic Policy called “Delaware: An Onshore Tax Haven” noted that the state’s lack of transparency combined with an enticing loophole in its tax code “makes it a magnet for people looking to create anonymous shell companies, which individuals and corporations can use to evade an inestimable amount in federal and foreign taxes.”

A New York Times lead article focuses on the Panamanian law firm Mossack Fonseco, here, which is at the center of the latest leaks so prominent in the news in the last few days. Kirk Semple, Azam Ahmed and Eric Lipton, Panama Papers Leak Casts Light on a Law Firm Founded on Secrecy (NYT 4/6/16), here The Panama Papers Overview of the Report ishere (with links); My blog on the Panama Papers Report is ICIJ Panama Report on Offshore Financial and Enabler Skulduggery (4/4/16; 4/5/16), here,

There are a vast number of news articles on the report and its ramifications. The scope of the Panama Papers is so large that I expect that many more articles will appear for some time into the future. I cannot read them all. I can read selectively and pass on to the blog's readers the ones I think useful. But my sampling is necessarily anecdotal. With that caveat, I excerpt key portions from the NYT article:

The firm, Mossack Fonseca, was built on assurances of bulletproof privacy for its clients. But its operations were laid bare this week by a vast leak of millions of documents that have helped expose the proliferation of shell companies and tax havens for the world’s wealthiest people.

Among the leaked documents was an email exchange obtained by the International Consortium of Investigative Journalists, in which the firm’s top partners realized they had worked for years with clients from Iran who had been listed on a sanctions list published by the United States government and the United Nations.

“This is dangerous!” Mr. Mossack wrote in an email to Mr. Fonseca and others at the firm. “A red flag should have been raised immediately.”

Mr. Mossack placed blame for the oversight on employees in the law firm’s London office who were “not doing their due diligence thoroughly, (or maybe none at all).”

Speaking of London, David Cameron’s EU intervention on trusts set up tax loophole Financial Times. Li: “David Cameron, hypocrite.”

Global Tax Haven Network Means Americans Can Hide Wealth At Home Real News

David Cameron admits he profited from father's Panama offshore trust fund

'Frankly and morally wrong': David Cameron's past attacks on tax evasion

David Cameron has disastrously mishandled the crisis over his tax affairs

David Cameron's EU intervention on trusts set up tax loophole

Former HSBC boss tried to avoid tax on £8m Kensington house

Now HSBC executives facing calls to resign: Pressure growns over Panama Papers

HSBC, Coutts & Rothschild: British banks help the 1% evade

Mossack Fonseca's role in fight over painting stolen by Nazis (8 Apr 2016)

David Cameron admits he profited from father's Panama offshore trust fund

'Frankly and morally wrong': David Cameron's past attacks on tax evasion

David Cameron has disastrously mishandled the crisis over his tax affairs

David Cameron's EU intervention on trusts set up tax loophole

Former HSBC boss tried to avoid tax on £8m Kensington house

Now HSBC executives facing calls to resign: Pressure growns over Panama Papers

HSBC, Coutts & Rothschild: British banks help the 1% evade

Mossack Fonseca's role in fight over painting stolen by Nazis (8 Apr 2016)